In the year 2012, the Central Bank of Nigeria (CBN) issued a circular to all banks and other financial institutions under its purview to render various Anti-money laundering and combating financing of terrorism (AML/CFT) returns in prescribed formats and at appropriate periods in line with extant AML/CFT laws and regulations.

The Money Laundering (Prohibition) Act (MLPA), 2011 (as amended) and CBN AML/CFT Regulations, 2013 require Banks and other financial institutions to render the various returns to the CBN and NIGERIA FINANCIAL INTELLIGENCE UNIT (NFIU).

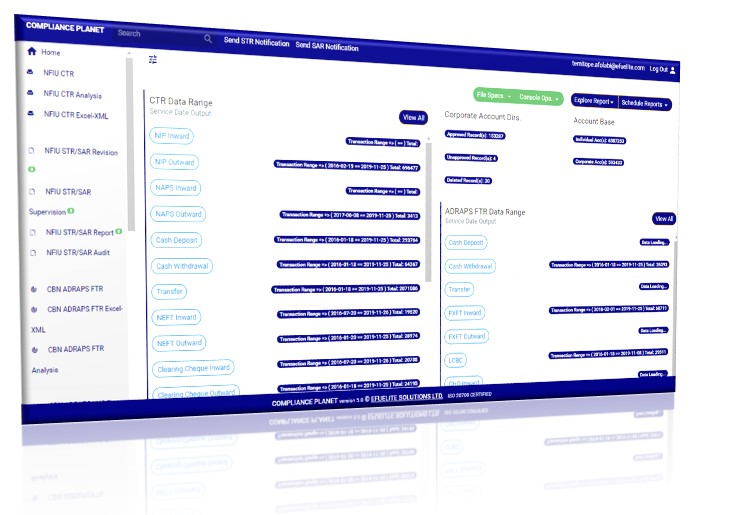

The deadline for submission of the returns varies from one report to another. Failure to render these statutory returns and to comply with regulatory directives attracts sanctions, including revocation of operating licence. The compliance planet processes these various returns. Thus, reducing reputational and operational risk and increasing business efficiency. Some of these reports are;

- Currency/Foreign Transaction Reports (CTR FTR)

- Suspicious Transaction Reports (STR/SAR)

- Foreign Currency Transaction Reports (ADRAPS FTR)

- Three Tiered KYC (Know Your Customer) (ADRAPS KYC)

- Politically Exposed Persons (ADRAPS PEP)

- Risk Based Assessment Report (AML/CFT RBS)

Compliance Planet also does Data Governance, Transaction Monitoring, thus, placing the institution in a safe haven fully in compliance with the regulatory standards.

For further enquiries :

Tel +234(0) 816 555 9818

Email solutions@efuelite.com

Insightful and helpful post, excellent breakdown of Compliance Planet’s AML reporting and monitoring capabilities. Your clear, concise overview is a valuable resource for compliance professionals.

LikeLike