Anti-Money laundering and Countering Financing of Terrorism regulations places obligations on financial institutions to detect and deter money laundering and terrorism financing. A financial institution is required to render an STR/SAR report to the Nigerian Financial Intelligence Unit within twenty-four hours and inform the CBN of same whenever it detects a known or suspected criminal violation of MLPA or a suspicious transaction related to money laundering activity or a violation of other laws & regulations.

A suspicious transaction is one for which there are reasonable grounds to suspect that the transaction whether or not made in cash is related to a money laundering offence or a terrorist activity financing offence. A suspicious activity refers to any observed behaviour or event that could indicate terrorism or terrorism-related crime.

STR/SAR OPERATIONS

Suspicions may arise from any branch of a financial institution. Upon any suspicion, there are processes that would kick-off to bring about an STR/SAR to be sent to the NFIU by the Compliance team. These processes are;

- Sending the SUSPICIOUS TRANSACTION REPORT or SUSPICIOUS ACTIVITY report to the compliance team

- Reviewing the SUSPICIOUS TRANSACTION REPORT or SUSPICIOUS ACTIVITY REPORT notification.

- Supervising the STR

- Reporting the transaction/activity

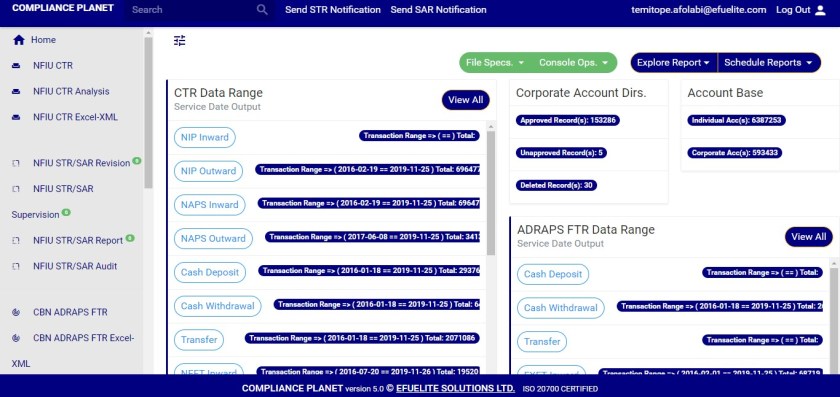

➔ To perform STR/SAR operations on the software, Click REPORT on the main dashboard as shown below

This will display a page as shown in fig. 6.1b below

(fig. 6.1b)

➔ All the processing desks have indicators that show if the desks have pending requests or not.

For further enquiries :

Tel +234(0) 816 555 9818

Email solutions@efuelite.com