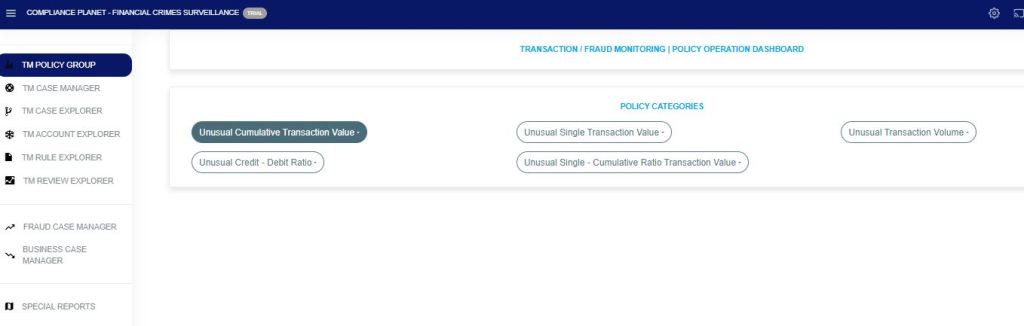

The Compliance Planet Anti Money Laundering/Core Bank Finance Software has several policy groups under Transaction/Fraud Monitoring to handle a wide range of monitoring scenarios.

Below are the different policy categories and their explanation.

- UNUSUAL SINGLE TRANSACTION VALUE

This policy category allows the creation of transaction/fraud monitoring rules to monitor single transaction inflow and/or outflow over a specified period. This policy category allows setting dynamic periods from account inception, account age (moving period of account birth date), etc. It will give instant signals in a change in customer transaction threshold behavior. - UNUSUAL TRANSACTION VOLUME

This policy category facilitates the creation of transaction/fraud monitoring rules to track inflows and outflows that surpass a predetermined threshold based on the total volume of transaction activity over a set timeframe. It provides real-time alerts for any potentially suspicious customer transaction count/volume. - UNUSUAL CUMULATIVE TRANSACTION VALUE

This policy category enables the formulation of transaction/fraud monitoring rules to track inflows and outflows that exceed a defined threshold based on the total accumulated transaction value over a designated period. The policy generates immediate alerts when there is a notable change in the customer’s transaction threshold behavior. - UNUSUAL CREDIT/DEBIT TRANSACTION RATIO

This policy category enables the creation of transaction/fraud monitoring rules to track inflows and outflows that exceed a designated credit/debit ratio above the total cumulative transaction, both inflows and outflows, over a specific time frame. It also allows for configuring adaptable periods, from the account’s creation to its current age, based on the account’s start date. The system provides immediate notifications when there are alterations in the customer’s transaction behavior. - UNUSUAL SINGLE CUMULATIVE RATIO TRANSACTION VALUE

This policy category allows the creation of transaction/fraud monitoring rules to track inflows and outflows that exceed a defined percentage above the total cumulative transaction values, either inflow or outflow, accumulated over a specific past timeframe. It introduces the ability to set flexible monitoring periods, from the account’s inception, its current age, and other customizable intervals. It provides immediate alerts for unusual or potentially fraudulent customer transaction patterns.

One thought on “Digital Financial Crimes Surveillance Policy Categories Explanation In Compliance Planet Anti Money Laundering/Core Banking Finance Software”