The compliance planet keeps a record list of all PEP reports that have been manually scheduled. In this section, you will learn how to find your scheduled PEP report and some other features to give you the best experience.

NOTE: Only person(s) assigned right to ‘View PEP report’ can carry out this operation

STEP 1: From the left hand side menu, click on ‘CBN ADRAPS PEP LIST’ Check out fig. 4.7a below

(fig. 4.7a)

➔ This displays a page as in fig. 4.7b below.

(fig. 4.7b)

STEP 2: Click on the START DATE button/box and the END DATE button/box to set the beginning and the end of the period in which the reports you want to see have been scheduled for. See how to do this in fig. 4.7c below.

Fig. 4.7d shows a labelled calendar to guide you on how to make use of the calendar.

(fig. 4.7c)

➔ Take a look at the arrows labelled a to d in fig. 4.7d to study the calendar.

a. Click on the given year to change it to your year of choice.

b. Click on the given month to change it to your month of choice.

c. Then, click on the date of the month.

d. You can also click on the angle brackets on the calendar [ ‘’ ] to go backward or forward.

(fig. 4.7d)

➔ For instance to see reports for June, 2018, the start and end date would be 06/01/2018 and 06/30/2018 respectively. See an example in fig. 4.7e below.

(fig. 4.7e)

➔ You can increase the number of reports you want to see per page by clicking on the ENTRIES box. Pick any number of entries per page of your choice. See fig. 4.7f below for an example.

(fig. 4.7f)

STEP 3: Click on the VIEW button to see the reports. It is an orange color button at the upper area of the page, next to the END DATE box. By doing this, the software will make a search and reports that were scheduled for that period you have entered in the date boxes will be displayed. See fig. 4.7g to see the pointer clicking on the view button and see the results of the example in fig. 4.7h.

(fig. 4.7g)

(fig. 4.7h)

➔ You can make changes to your date but to effect the changes you have made on the page, click on VIEW. For instance; when you change the date entries, click on view to see the reports for the new date range you have just set.

➔ The results of the report(s) that fall within that date range will be displayed row by row. On every row, for each report, the software will give information about the number of transactions contained in each report, the number of accounts involved, the number of Excel files and XML files the software has exported report information into, the execution date and time, the start date and end date, the type of report, and a comment on whether the processing of the report has been completed or not. See fig. 4.7h above.

➔ The numbers under the ‘Tran’ column (in fig. 4.7h) represent the number of transactions carried out by the PEPs that are being reported in the respective reports. By clicking on the number of transactions, the software will display a page that gives a list of the transactions carried out by the PEPs in the particular report. See fig. 4.7i below for an example of a PEP repository transaction(s) page.

(fig. 4.7i)

➔ See the following steps (a – f) on how to make use of the features on the PEP Repository Transaction page.

a) Click on the entries box to adjust the number of transactions you want to see per page. See fig. 4.7j below for an example on how to do this. The software will automatically effect your changes.

(fig. 4.7j)

b) Click on the filter box to select a bank branch for which you want to see PEP transactions. See fig. 4.7k below for an example on how to do this.

(fig. 4.7k)

c) After selecting the bank branch of your choice as in fig. 4.7k above, click on VIEW to see the transactions attached to the selected bank branch. See fig. 4.7l for an example on how to do this.

(fig. 4.7l)

d) You can search for a particular transaction using an account number, account name, reference number, transaction type, narration, amount or transaction mode. To do this, type in the search term in the search box as in the example in fig. 4.7m below. The software will automatically search out your search term as soon as you type in a character in the search box. You do not have to click on the VIEW button for the software to carry out a search.

(fig. 4.7m)

e) At the end of the page, the bottom-right corner, the software gives information about the number of pages of your result, with the page numbers written out. All the page numbers represent buttons for each page. By clicking on any page number, the software takes you to that particular page. There is the NEXT button to take you to the next page when you click on it and there is a PREVIOUS button to take you to the page before the one you are viewing at that moment. See these features in fig. 4.7i, fig. 4.7j, fig. 4.7k, fig. 4.7l and fig. 4.7m

f) To close this page, click on the DISMISS button at the bottom-right corner of the page. Check out fig. 4.7i, fig. 4.7j, fig. 4.7k, fig. 4.7l and fig. 4.7m above to see this button.

➔ The numbers under the ‘Acc’ column (in fig. 4.7h) represent the number of PEP accounts being reported in each report. By clicking on the number of accounts, the displays a page showing list of the PEP accounts and their respective details. See fig. 4.7n below to see an example of the PEP repository account(s) page.

(fig. 4.7n)

➔ See the following steps (a – f) on how to make use of the features on the PEP Repository Account(s) page.

a) Click on the entries box to adjust the number of accounts you want to see per page. See fig. 4.7o below for an example on how to do this. The software will automatically effect your changes whenever you do this.

(fig. 4.7o)

b) Click on the filter box to select a bank branch for which you want to see PEP accounts. See fig. 4.7p below for an example on how to do this.

(fig. 4.7p)

c) After selecting the bank branch of your choice as in fig. 4.7p above, click on VIEW to see the accounts attached to the selected bank branch. See fig. 4.7q for an example on how to do this.

(fig. 4.7q)

d) You can search for a particular account using the account number, account name or BVN. To do this, type in the search term in the search box as in the example in fig. 4.7r below. The software will automatically search out your search term as soon as you type in a character in the search box. You do not have to click on the VIEW button for the software to carry out a search.

(fig. 4.7r)

e) At the end of the page, the bottom-right corner, the software gives information about the number of pages of your result, with the page numbers written out. All the page numbers represent buttons for each page. By clicking on any page number, the software takes you to that particular page. There is the NEXT button to take you to the next page when you click on it and there is a PREVIOUS button to take you to the page before the one you are viewing at that moment. See these features in fig. 4.7n, fig. 4.7o, fig. 4.7p, fig. 4.7q and fig. 4.7r

f) To close this page, click on the DISMISS button at the bottom-right corner of the page. Check out fig. 4.7n, fig. 4.7o, fig. 4.7p, fig. 4.7q and fig. 4.7r above to see this button.

➔ The numbers under the ‘Excel’ column (in fig. 4.7h) also represent the number of Excel files that the software has written the report into. By clicking on the number of Excel files, a page will be displayed on the screen. See fig. 4.7s below for an example of the page..

(fig. 4.7s)

➔ The PEP Repository Excel file(s) page gives information about the Excel file name(s), the number of times users have downloaded the file and the download history. See the following steps (a -d) on how to make use of its features.

a) Click on the entries box to adjust the number of Excel files you want to see per page. See fig. 4.7t below for an example on how to do this. The software will automatically effect your changes whenever you do this.

(fig. 4.7t)

b) Click on the file name to download the Excel file to your computer. The file name is underlined and the download happens immediately! The number of download changes as soon as you click on the file name. Compliance software is fast and easy! See fig. 4.7u below for an example on how to download PEP excel file.

NOTE; Only person(s) assigned right to ‘View PEP report’ and ‘Download PEP report’ can carry out this operation

(fig. 4.7u)

c) To see who downloaded the file and the time of download, click on the ‘File Download History’ button. A small console will be displayed on the page as in fig. 4.7v below for an example. Close the console using the DISMISS button at the bottom-right corner of the console.

(fig. 4.7v)

d) Also, at the the bottom-right corner of the PEP Repository Excel file(s) page, the software gives information about the number of pages of the PEP Repository Excel file(s) list,, with the page numbers written out. All the page numbers represent buttons for each page. By clicking on any page number, the software takes you to that particular page. The NEXT button will take you to the page after the one you are viewing at the moment, while the PREVIOUS button will take you to the page before the one you are viewing at that moment. To close this page, click on the DISMISS button. It is also at the bottom-right corner of the page.

➔ The numbers under the ‘XML’ column (in fig. 4.7h) also represent the number of XML files that the software has written the respective report into. By clicking on the number of XML files, a page will be displayed on the screen. See fig. 4.7w below for an example of the page.

(fig. 4.7w)

➔ The PEP Repository XML file(s) page also gives information about the XML file name(s), the number of times users have downloaded the file(s) and the download history. There are 500 PEP transactions per XML file. See the following steps (a – d) on how to make use of its features. The features on the PEP Repository XML file(s) page work like those of the PEP Repository Excel file(s) page.

a) Click on the entries box to adjust the number of XML files you want to see per page. See fig. 4.7x below for an example on how to do this. The software will automatically effect your changes whenever you do this.

(fig. 4.7x)

b) Click on the file name to download the XML file to your computer. The number of download changes as soon as you click on the file name. The file name is underlined and the download is immediately also! See fig. 4.7u below for an example on how to download PEP XML file.

NOTE; Only person(s) assigned right to ‘View PEP report’ and ‘Download PEP report’ can carry out this operation

(fig. 4.7y)

c) To see who downloaded the file and the time of download, click on the ‘File Download History’ button. A small console will be displayed on the page as in fig. 4.7v below for an example. Close the console using the DISMISS button at the bottom-right corner of the console.

(fig. 4.7z)

d) Here also, at the the bottom-right corner of the PEP Repository XML file(s) page, the software gives information about the number of pages of the PEP Repository XML file(s) list,, with the page numbers written out. All the page numbers represent buttons for each page. By clicking on any page number, the software takes you to that particular page. The NEXT button will take you to the page after the one you are viewing at the moment, while the PREVIOUS button will take you to the page before the one you are viewing at that moment. To close this page, click on the DISMISS button at the bottom-right corner of the page.

➔ Back to fig. 4.7h – Pep Repository list page, at the end of each report row, the software shows if the processing of the report is enabled or dis-enabled under the ‘ACTIVE’ column.

➔ For reports that have been completed, their status will read, ENABLED. See fig. 4.7h for an instance.

➔ For reports that have not been completed, there will be an extra button next to their ACTIVE status. This button is used to ACTIVATE or DEACTIVATE the processing of the report. See fig. 4.7aa below for an example. The button turns red when the report is enabled and it can be used to DEACTIVATE the report. It is green when the report is dis-enabled and it can be used to ACTIVATE the report for processing.

NOTE; Only person(s) assigned right to ‘View PEP report’ and ‘Edit PEP report’ can carry out this operation

(fig. 4.7aa)

➔ As in fig. 4.7aa above, the report has not been completed. Click on Activate to enable processing of report or Deactivate to disable the report.

➔ Clicking on ACTIVATE turns the status bar of the report to green with an ‘ENABLED’ inscription, while clicking on DEACTIVATE will turn the status bar back to red with an ‘DIS-ENABLED’ inscription. See fig. 4.7ab and fig. 4.7ac to see the result of activating the report for an example and see fig. 4.7ad and fig. 4.7ae to see the result of deactivating the report for another example.

●Activating a report

(fig. 4.7ab)

(fig. 4.7ac)

●Deactivating a report

(fig. 4.7ad)

(fig. 4.7ae)

➔ At the end of the page, the software gives information about the number of pages of your result, with the page numbers written out. All the page numbers represent buttons for each page. By clicking on any page number, the software takes you to that particular page. There is the NEXT button to take you to the next page when you click on it and there is a PREVIOUS button to take you to the page before the one you are viewing at that moment. See these features in fig. 4.7af below.

(fig. 4.7af)

For further enquiries :

Tel +234(0) 816 555 9818

Email solutions@efuelite.com

Web http://solutions.efuelite.com

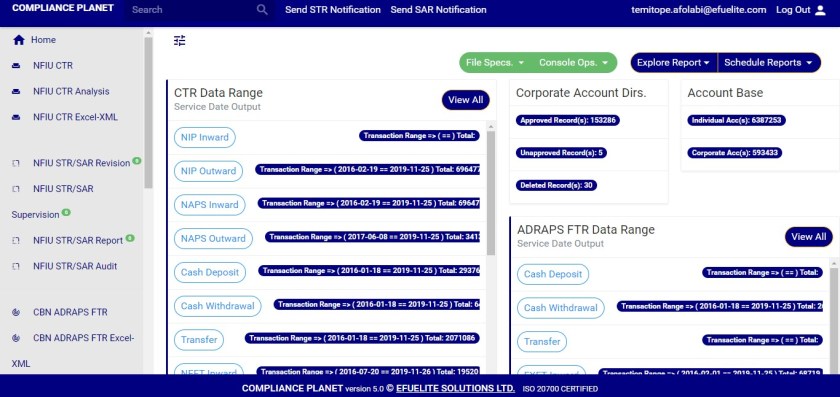

(Fig 6.2.2a)

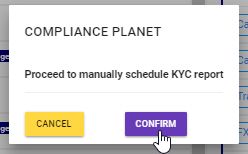

(Fig 6.2.2a) (Fig 6.2.2c)

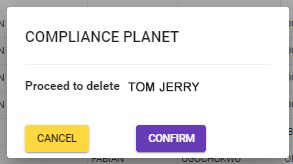

(Fig 6.2.2c) (Fig 6.2.2e)

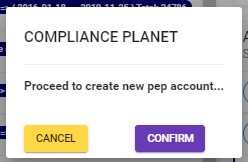

(Fig 6.2.2e)