WHAT IS A CTR FTR REPORT?

WHAT ARE THE CTR FTR TYPES?

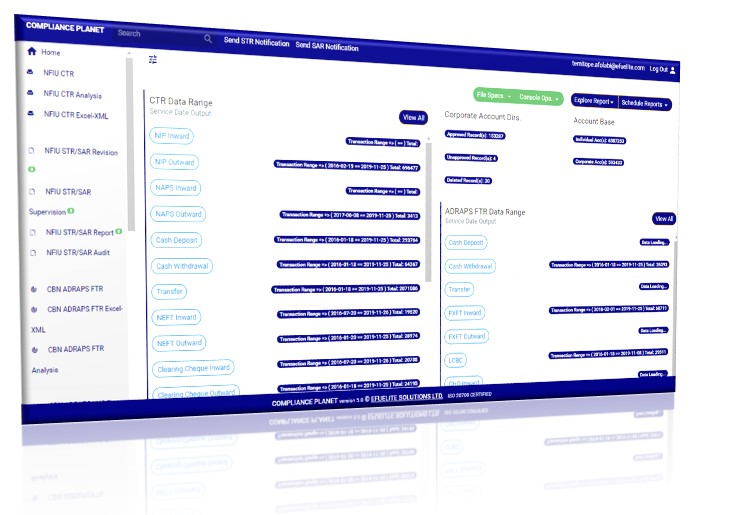

Currency Transaction/ Foreign Transaction types include NIP, NAPS, NEFT, Cheques, Cash deposits, Cash withdrawal, Transfer, FXFT, RTGS and REMITA, Investment Booking Transactions, Managers Cheque etc.

Another example; when an NIP Transaction is carried out. When it comes to reporting, the NIP transaction will be regarded as NIPInward if the reporting bank is receiving the value or NIPOutward if the bank is giving out the value.

The transaction types represent the different payment service platforms and they are explained briefly below.

NIP (NIBSS INSTANT PAYMENT)

NAPS (NIBSS Automated Payment Services)

NAPS is an integrated multi-bank e-Payment, e-Collection and Payroll & Bulk payment Platform. It is designed for the instant processing of payroll, pension, personnel records and execution of funds, transfer, direct debit, collections, schedule delivery and payment instructions.

NIBSS

NIBSS stands for Nigeria Inter-Bank Settlement System. It was set up by the Bankers Committee in 1992, incorporated in 1993 as a Shared-Service infrastructure for facilitating payments finalities, streamlining Inter-bank payments and settlement mechanisms, to drive and promote Electronic Payments across the Nigerian Financial Industry. It is owned by the Central Bank of Nigeria (CBN) and all licensed Deposit Money Banks (DMBs) in Nigeria.

NEFT (National Electronic Funds Transfer)

NEFT is a payment system facilitating one-to-one funds transfer. Under this Scheme, individuals can electronically transfer funds from any bank branch to any individual having an account with any other bank branch in the country participating in the Scheme. A NEFT transaction could either be inward or outward too.

CHEQUES

A Cheque is a document that orders a bank to pay a specific amount of money from a person’s account to the person (the payee) in whose name the cheque has been issued. The drawer writes the various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering his/her bank, known as the drawee, to pay that person or company the amount of money stated. The transactions that involve the use of a cheque fall under “cheques” in the Compliance planet and they could be inward or outward clearing.

RTGS (Real Time Gross Settlement)

RTGS is a specialist funds transfer systems where the transfer of money or securities takes place from one bank to another on a “real time” and on a “gross” basis. Settlement in “real time” means a payment transaction is not subjected to any waiting period, with transactions being settled as soon as they are processed. “Gross settlement” means the transaction is settled on one-to-one basis without bundling or netting with any other transaction. “Settlement” means that once processed, payments are final and irrevocable.

RTGS systems are typically used for high-value transactions that require and receive immediate clearing. That is, payments that need to be settled urgently. RTGS transactions could be either inward or outward.

REMITA

Remita is an electronic payment platform that helps people and organizations to simply receive and effect payments across all banks, from anyplace and at any time. This system was Introduced by the Nigerian Federal Government, implemented by the CBN and is recognized by all of the Nigerian commercial banks and more than 400 small banks. This system electronically generates a 12-digit code that is called “Remita Retrieval Reference” Number (RRR) for making financial payments. It is a popular online payment solution for Nigerians

FXFT (FOREIGN EXCHANGE FOREIGN TRANSACTION)

FXFT refers to the sale or purchase of foreign currencies. This transaction involves the currencies of two countries. Simply put, the foreign exchange transaction is an agreement of exchange of currencies of one country for another at an agreed exchange rate on a definite date.

INTERNAL TRANSFER

On the compliance planet, Transfer simply refers to internal transfer of money between customers of the same reporting financial institution.

CASH DEPOSITS

This refers to injecting of funds into an account.

CASH WITHDRAWAL

A withdrawal simply means removing funds from a bank account, savings plan, pension or trust. A cash withdrawal is a transaction in which a customer receives back money that had been previously deposited in his/her account.

INVESTMENT BOOKING

Investment booking can also be referred to as FIXED DEPOSIT. A fixed deposit is simply a lump sum deposited with a bank for a fixed period/amount of time, in exchange for interest. It is an investment instrument offered by banks and other financial institutions, which provides investors with a higher rate of interest than a regular savings account, until the given maturity date. Investment booking can also be inward or outward.

MANAGER’S CHEQUE

A manager’s cheque is a secure cheque issued by a bank, payable to a payee as indicated by the person who purchased it. It is often used in situations when the beneficiary does not accept cash or personal cheques. The person who purchases the check pays the bank the amount of money for which the cheque is issued either in cash or from his bank account. He is then guaranteed acceptance of his cheque by the party receiving it. A manager’s cheque is also called treasurer’s cheque, official cheque and certified cheque. Another common name for a manager’s cheque is a cashier’s cheque.

LETTERS OF CREDIT

A Letter of Credit (LC) is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. It is a written undertaking given by a Bank (issuing Bank) at the request of its customer (applicant), in which the Bank obligates itself to pay the exporter (seller/beneficiary) up to a stated amount within a prescribed time frame upon presentation of stipulated documents that conform to the terms and conditions of the documentary credit. It is also known as a documentary credit or bankers commercial credit.

BILLS FOR COLLECTION

A Bill for Collection is the handling of documents (financial and/or commercial) by banks in accordance with instructions received from the exporter in order to; obtain payment or acceptance, deliver documents against payment and/or acceptance or deliver documents on other terms and conditions. Simply put, it is a trade transaction in which the exporter hands over the task of collecting payment for goods supplied to his or her bank, which sends the shipping documents to the importer’s bank together with payment instructions.

INTERSWITCH / AUTOPAY

AutoPAY is a web-based payment platform that allows individuals, corporate and government organisations to make payments from their bank account to beneficiaries in any of the 18 banks in Nigeria.

For further enquiries :

Tel +234(0) 816 555 9818

Email solutions@efuelite.com

Web http://solutions.efuelite.com