Under this control panel feature, the compliance planet provides a list of account schemes a financial institution has. The operations include editing, deleting, downloading and adding new account schemes, with options to carry out operations individually or in bulk.

Note: Only person(s) profiled as deputy supreme admin can carry out account scheme operations.

To perform any of the operations on Account schemes;

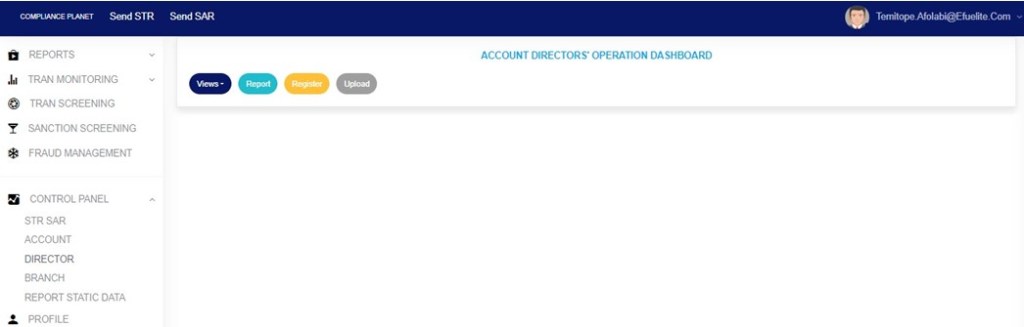

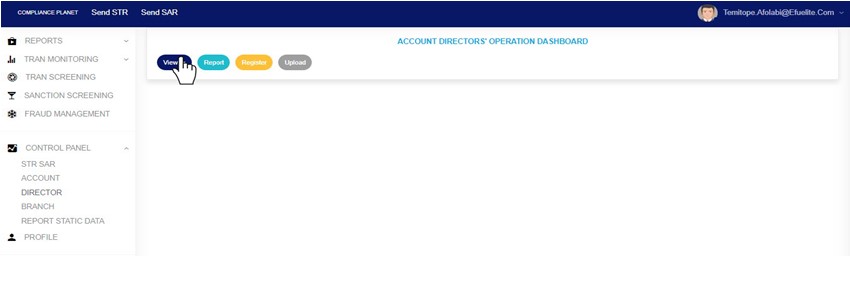

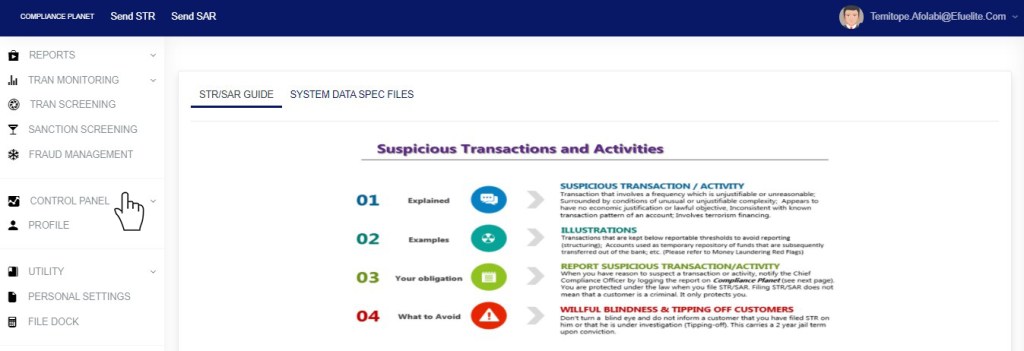

STEP 1: From the left hand side menu, Click ‘Control panel’ as in fig. 12.2a.

Fig 12.2a

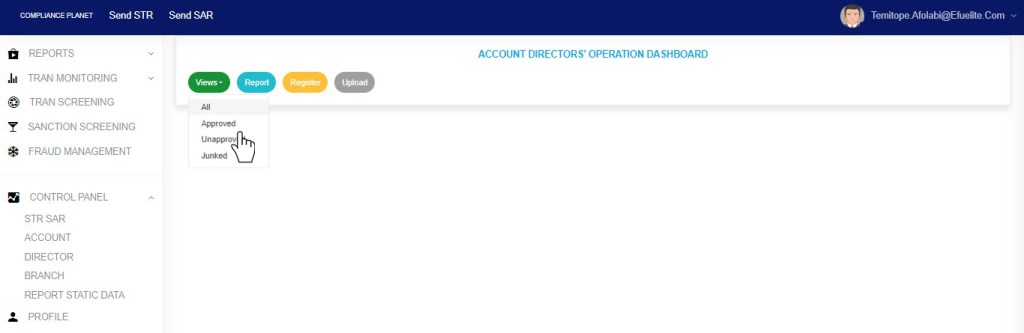

- This will display a drop down as in Fig 12.2b below.

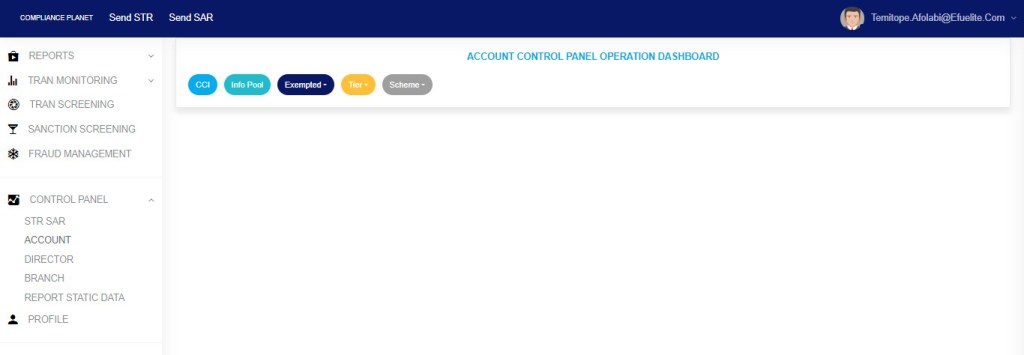

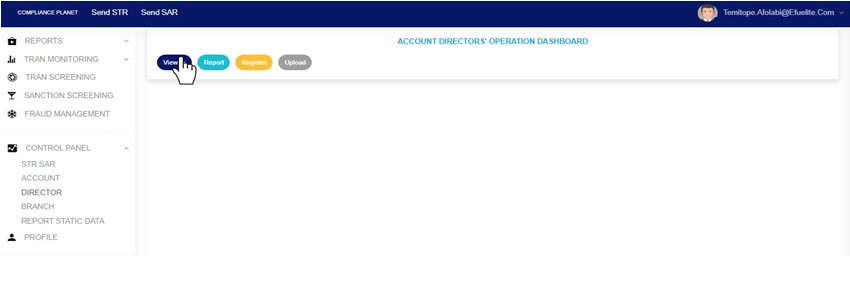

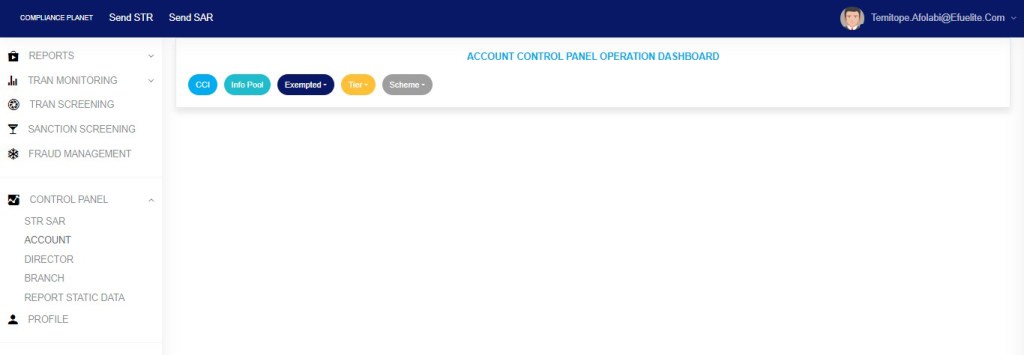

STEP 2: Click ‘ACCOUNT’ on the drop down list. See an example in Fig 12.2b below.

Fig 12.2b

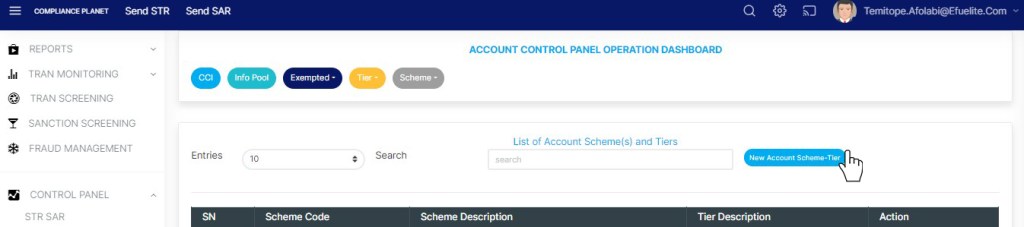

- This will display the ACCOUNT CONTROL PANEL OPERATIONS dashboard as in Fig 12.2c below

Fig 12.2c

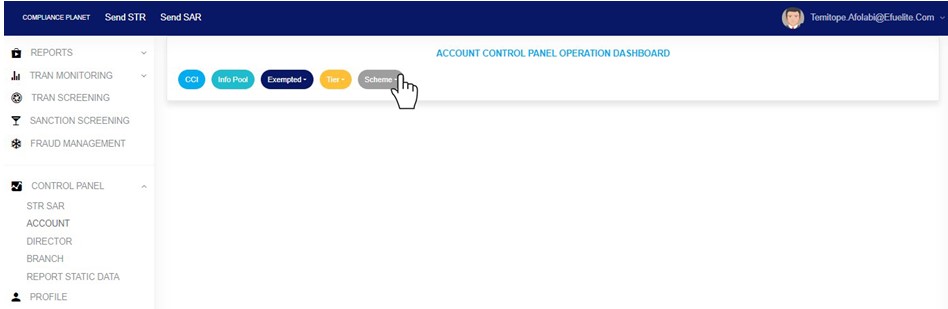

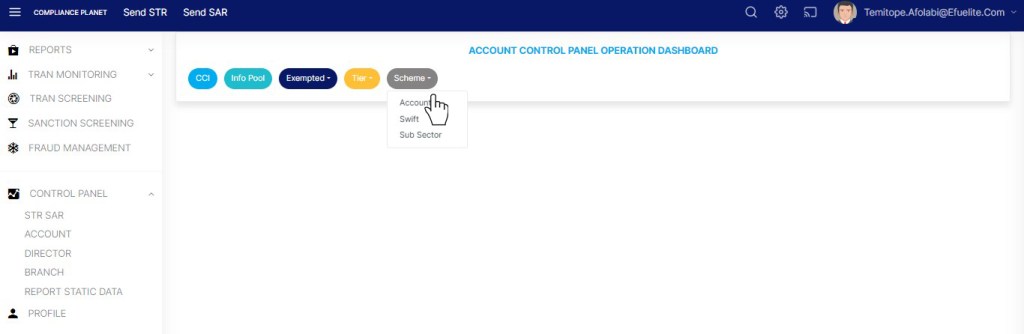

STEP 3: Click “SCHEME” from the top menu, on the account page. See an example in fig12.2d below

Fig 12.2d

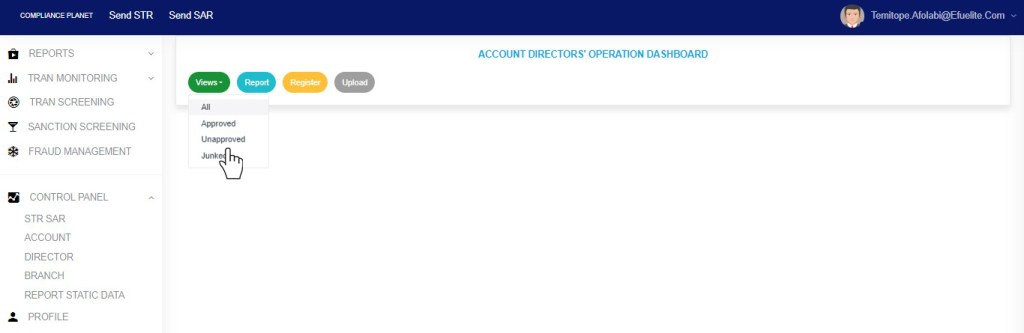

- This displays a dropdown as in fig 12.2e below

STEP 4: Click “Account” on the drop down list as in fig 12.2e below

Fig 12.2e

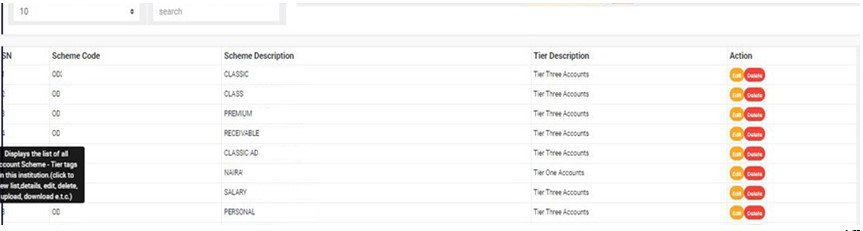

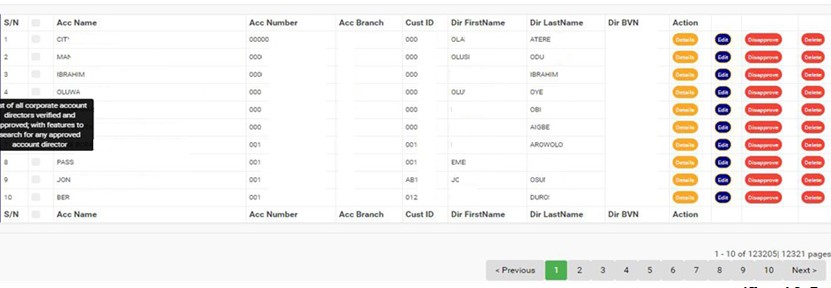

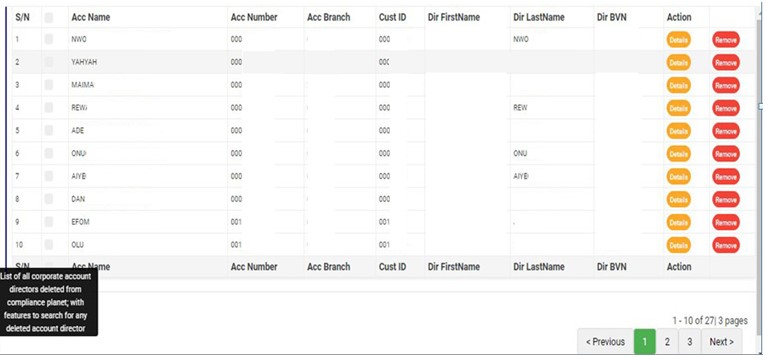

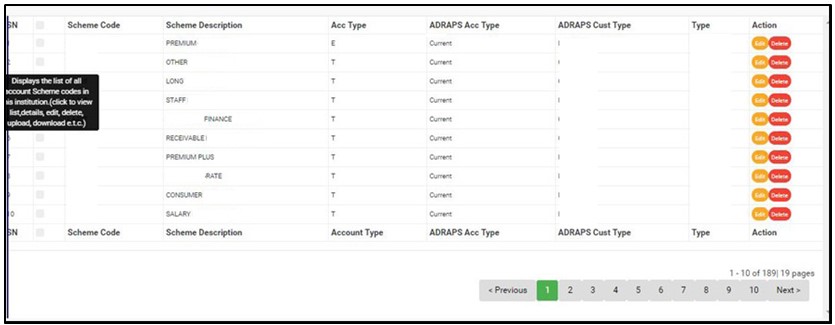

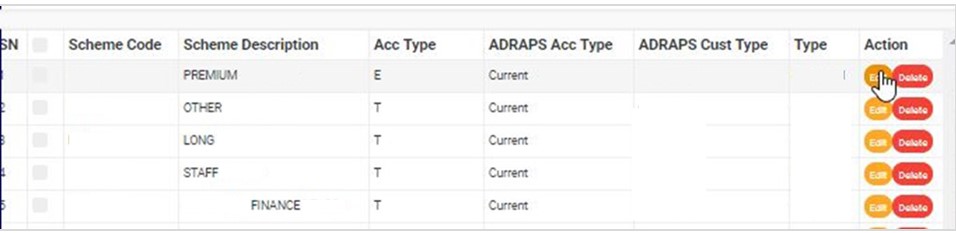

- This will display a page showing a list of all the financial institution’s account schemes. An account schemes comprises of a scheme code, an account type, an ADRAPS account type, an ADRAPS customer type and type. See fig. 12.2f for an example.

- Account type is an alphabetic representation of each account scheme in line with the provided schema description by NFIU.

- ADRAPS account type: This is the specification of an account type in line with ADRAPS requirements. ADRAPS account typecan either be ‘Current’, ‘Savings’ or ‘Deposit’.

- ADRAPS customer type: This refers to the various types of customer account types in accordance to CBN ADRAPS template/schema description file. The customer types are; Individual, Estate, Joint account, Corporate, Government, Association, N.G.O., Embassy, International agency, Government and ‘Others’.

- Type: This represents the financial institution’s classification of the account sub-package.

(fig. 12.2f)

- As seen in fig. 12.2f above, at the bottom-right corner of the page, the software gives information about the number of pages of the list, with the page numbers written out. The page numbers represent buttons to go to each page. By clicking on any page number, the software takes you to that particular page. Click on the ‘NEXT’ button to go to the next page or the ‘PREVIOUS’button to go to the page before the current page.

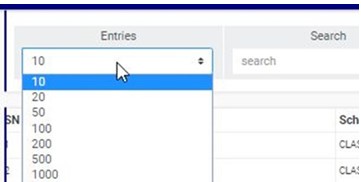

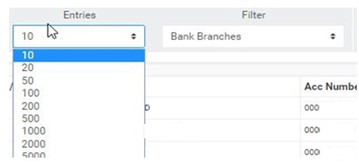

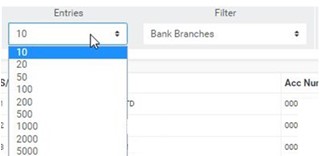

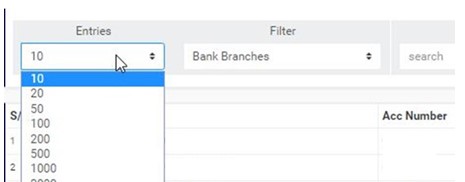

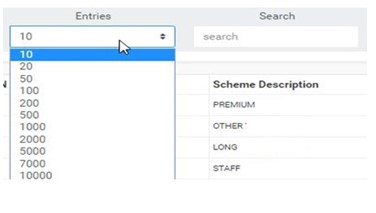

Click on the ‘ENTRIES’ box to adjust the number of account schemes you see per page. See how to adjust the number of entries per page in fig. 12.2g.

(Fig. 12.2g)

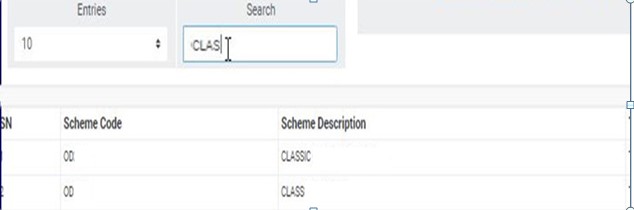

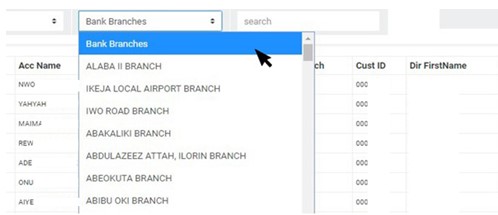

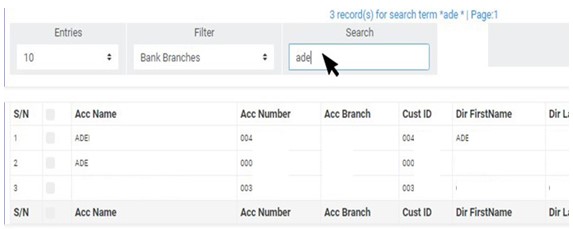

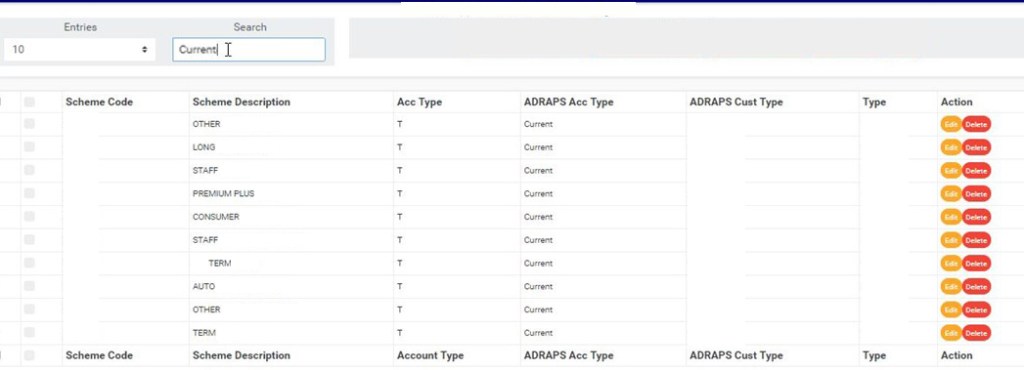

- Search for Account Schemes by inputting the account scheme code, scheme description, account type, ADRAPS account type or ADRAPS customer type in the search box as in fig. 12.2h below. Search results will appear immediately a character is typed in the search box.

(fig. 12.2h)

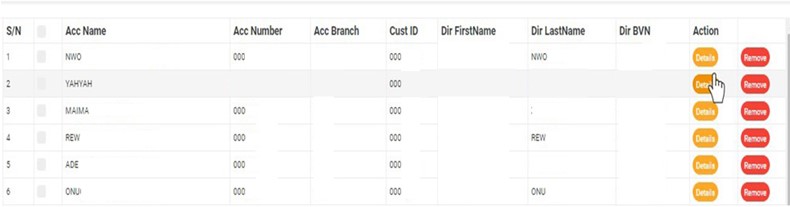

- Each Account scheme has two (2) action buttons; ‘Edit’ button and ‘Delete’ button. The different operations are explained below.

How to Edit an Account Scheme

- To change details of an account scheme;

STEP 1 Click on its ‘Edit’ button as shown in the example in fig. 12.2i below.

(fig. 12.2i)

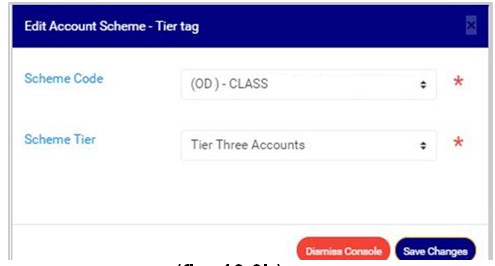

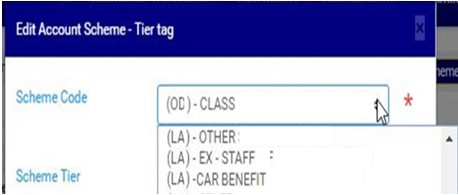

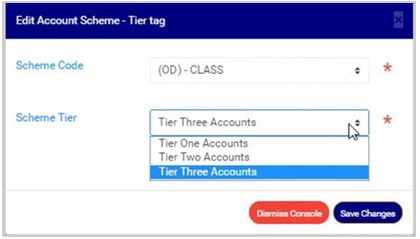

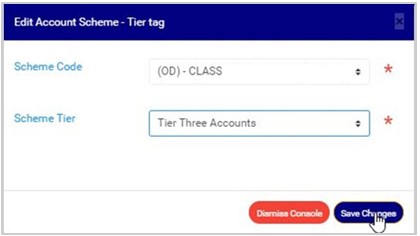

- Clicking on ‘Edit’ will display a console titled, ‘Edit Account Scheme’, as in fig. 12.2j.

(fig. 12.2j)

STEP 2: Fill in the details you want to add or change.

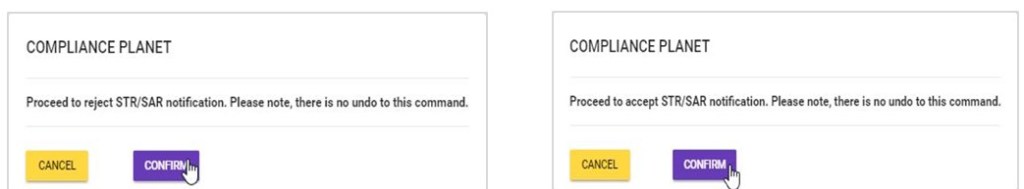

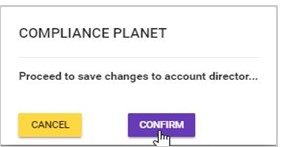

STEP 3: Click on ‘SAVE CHANGES’ as shown in fig. 12.2j above, to update the account scheme details on software. Clicking on ‘Save Changes’ will display a confirmation console as in fig. 12.2k to confirm you want to change the details.

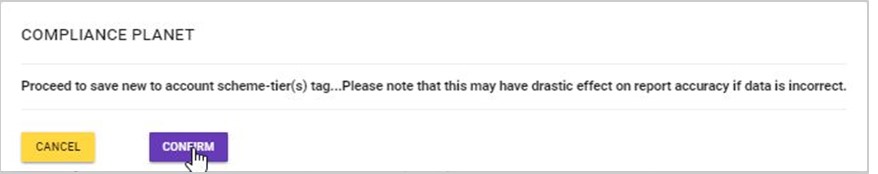

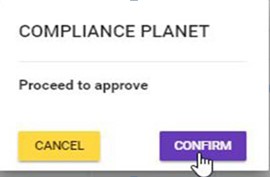

(fig. 12.2k)

- Click on ‘CONFIRM’ as in fig. 12.2k above to save the changes or cancel to discontinue action.

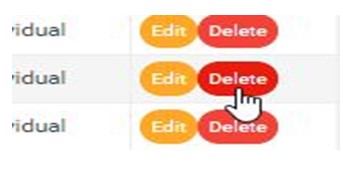

How to Delete an Account Scheme

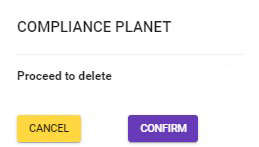

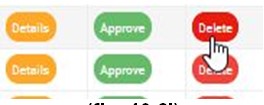

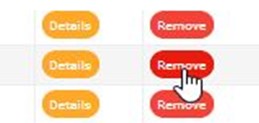

- To delete an account scheme, click on ‘DELETE’ as in fig. 12.2l .

(fig. 12.2l)

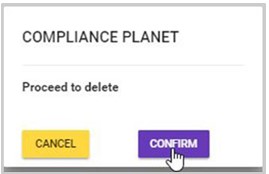

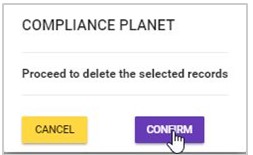

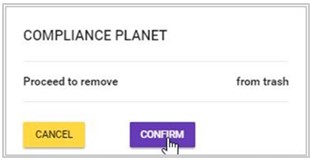

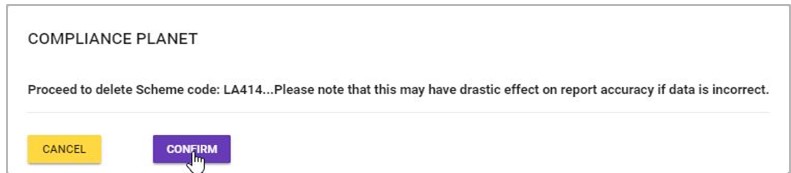

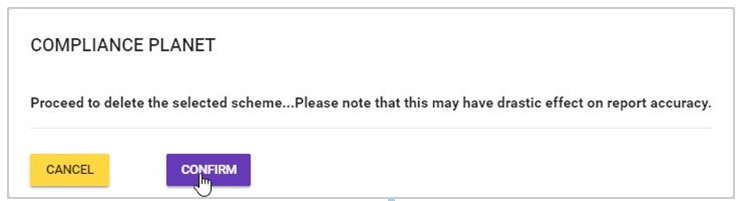

- This displays a confirmation console to confirm your request to delete that particular account scheme as in fig. 12.2m Click on ‘CONFIRM’ to proceed.

(fig. 12.2m)

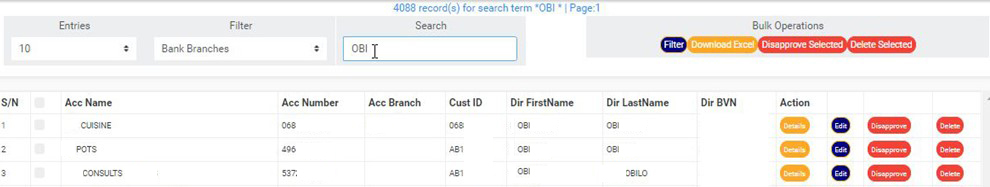

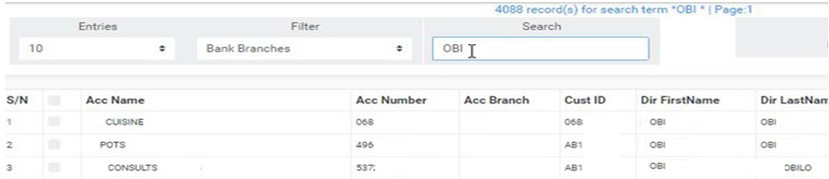

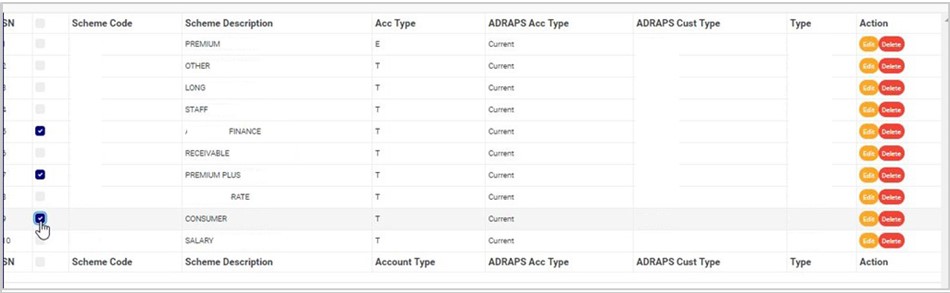

Bulk Operations

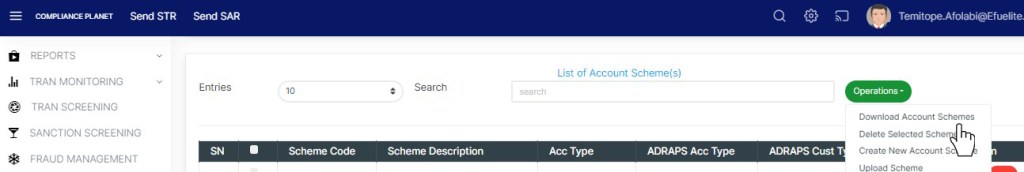

The action buttons available under the bulk operations section of the Account Scheme page are;

- Download account schemes

- Delete selected schemes

- New account scheme

- Upload scheme

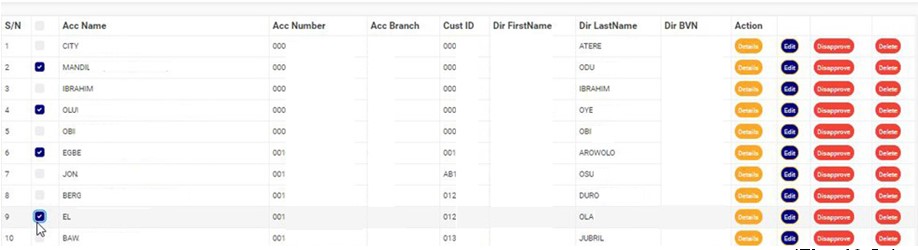

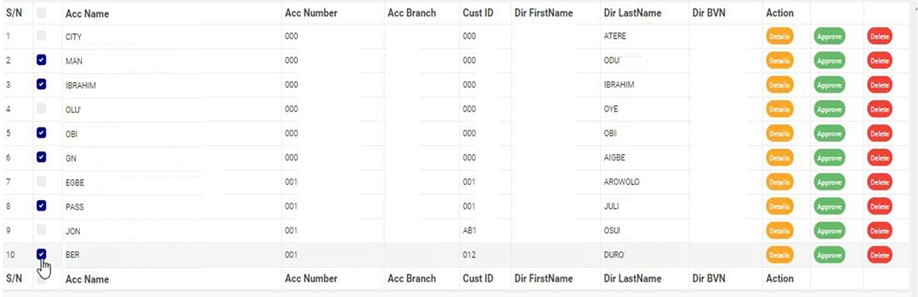

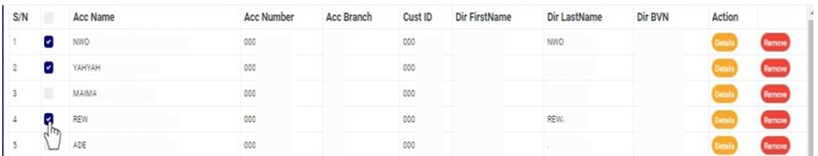

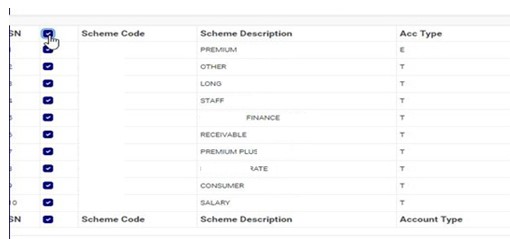

- To select an account scheme for treatment, mark the account scheme by clicking on its checkbox as shown in the example in fig. 12.2n below. One or more account schemes can be selected for bulk treatment as seen in the example.

(fig. 12.2n)

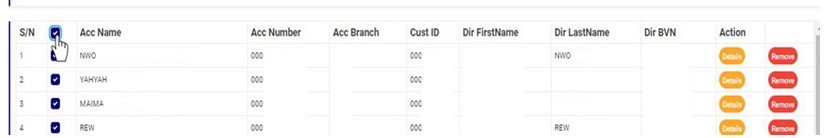

- To select or deselect all the account schemes on a page, click on the checkbox of the table title bar as in fig. 12.2o. This checkbox is between SN and Scheme Code.

(fig. 12.2o)

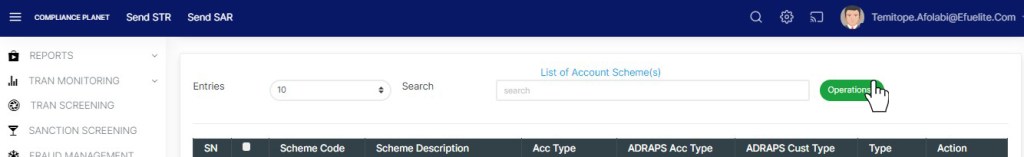

A) Downloading Account Schemes

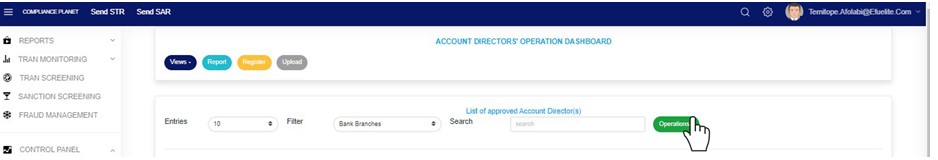

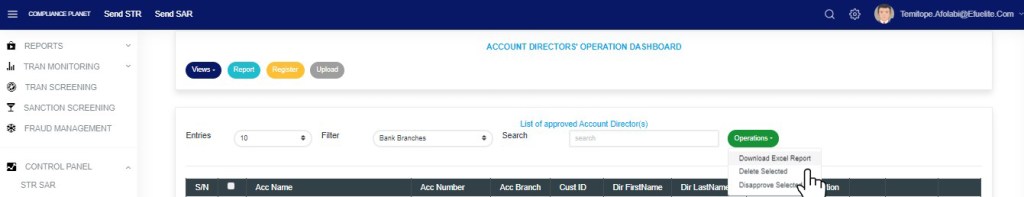

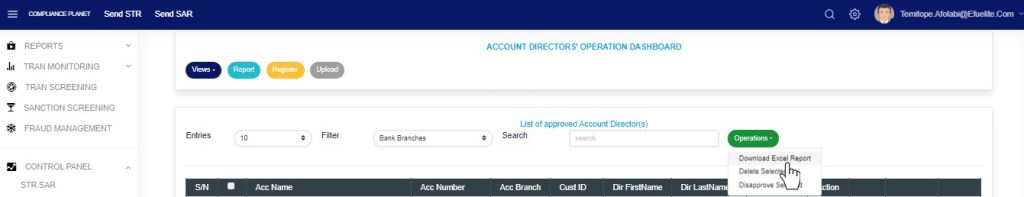

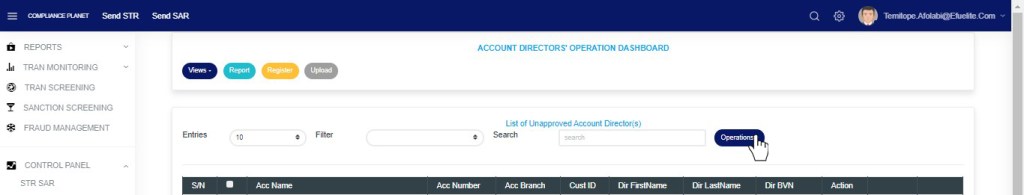

- To download all the financial institution’s account schemes on the software, Click “Operations” button on the top-right side of the page as in fig 12.2p below.

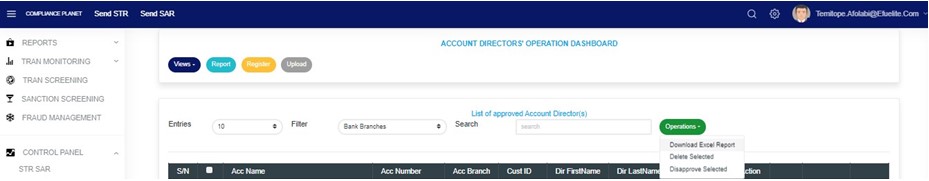

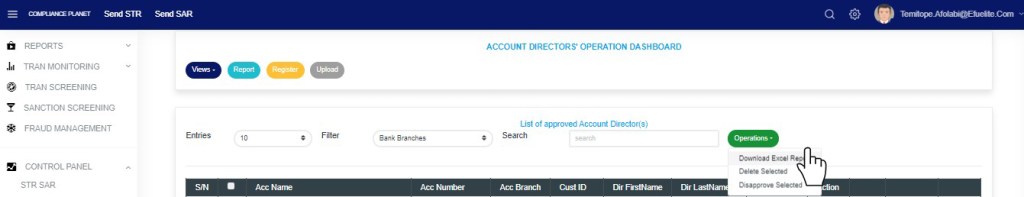

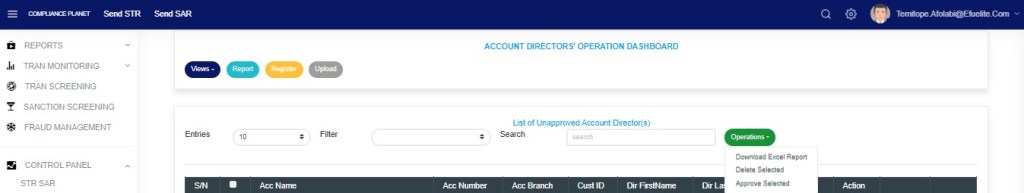

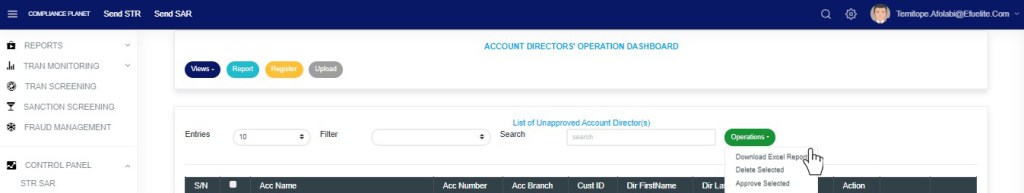

- This displays a dropdown list as in fig 12.2q below

- Click on ‘DOWNLOAD ACCOUNT SCHEMES’ as in fig. 12.2q. No need to mark all the account schemes.

(fig. 12.2q)

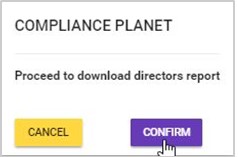

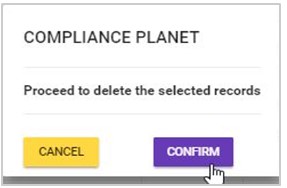

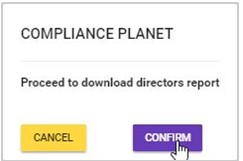

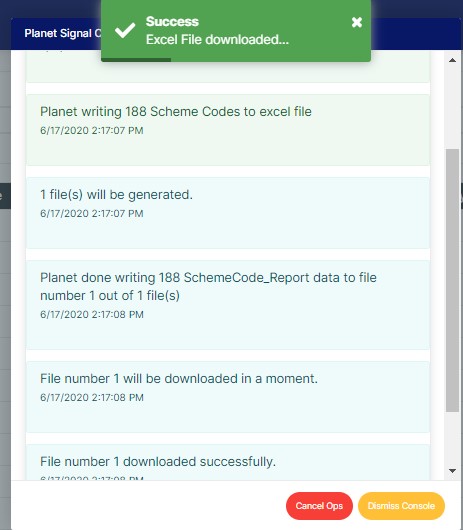

- Clicking on ‘DOWNLOAD ACCOUNT SCHEMES’ will display a confirmation console to confirm you want to download all the account schemes. Click on ‘CONFIRM’ as in fig. 12.2r to proceed with the download or ‘CANCEL’ to stop action.

(fig. 12.2r)

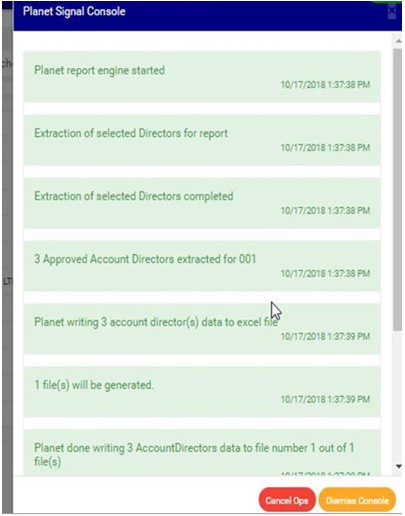

- If you proceed with the download, the signal console will show ongoing processes as in fig 12.2s below, and when download is complete, a notification will be displayed at the top of the page.

(fig. 12.2s)

B) Deleting Account schemes

- After selecting the account schemes to be deleted; Click on ‘DELETE SELECTED SCHEMES’ as in fig. 12.2t below

(fig. 12.2t)

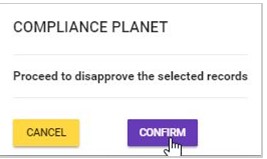

- Clicking on this bulk delete button will display a confirmation console to confirm your request as shown in fig. 12.2u below.

(fig. 12.2u)

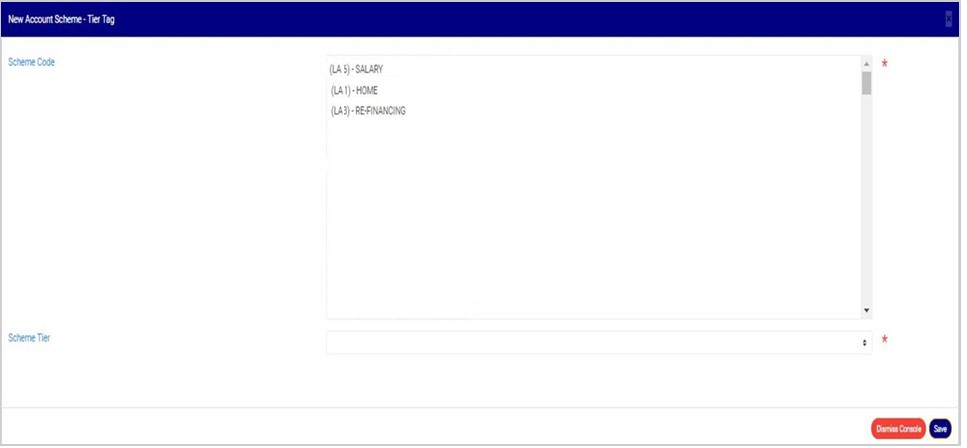

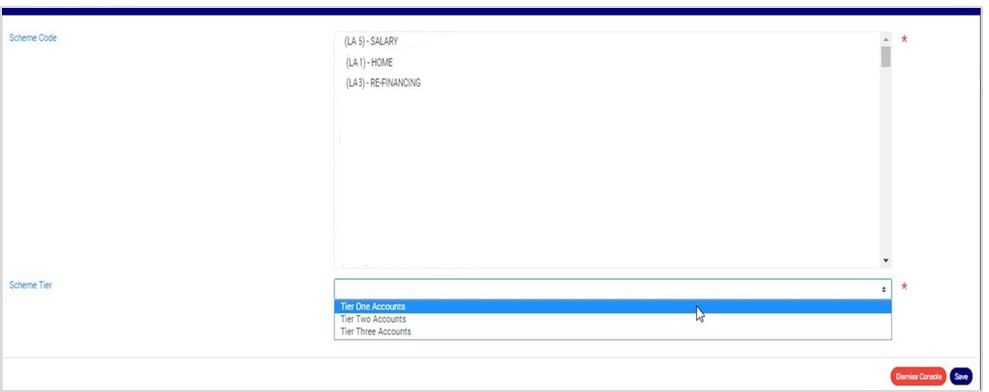

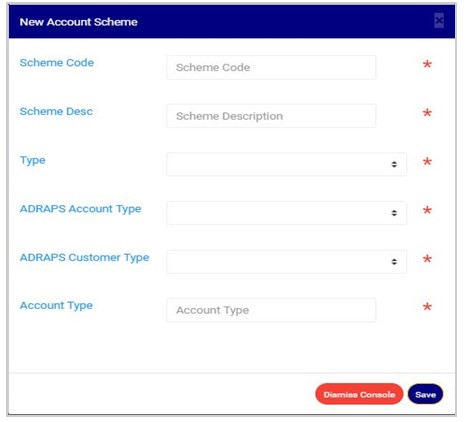

C) Creating A New Account Scheme

- To add a new account scheme on the software, click on ‘CREATE NEW ACCOUNT SCHEME’ as in fig. 12.2v below.

(fig. 12.2v)

- Clicking on ‘NEW ACCOUNT SCHEME’ will display a console titled, ‘NEW ACCOUNT SCHEME’. on which you are to input the details of the new scheme. See fig. 12.2w for an example.

(fig. 12.2w)

Fill in the details of the new account scheme in their respective fields. See fig. 12.2x for an example. After inputting the details, click on ‘SAVE’ as shown below.

(Fig. 12.2x)

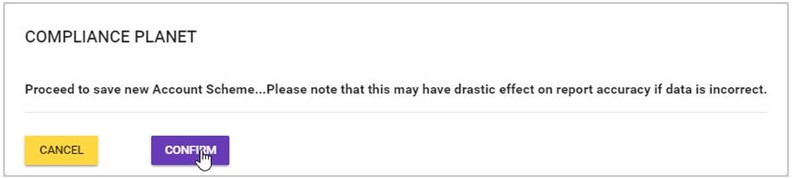

- Clicking on ‘SAVE’ will display a confirmation console to confirm you want to add a new account scheme as in fig. 12.2y. Click on ‘CONFIRM’ to proceed with the creation of a new Account scheme or ‘CANCEL’ to discontinue.

(fig. 12.2y)

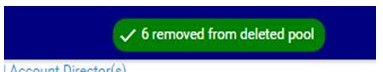

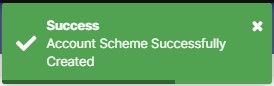

- If you proceed, a notification as in fig. 12.2z will be displayed at the top of the page when the account scheme has been successfully created. The new scheme would be added to the list of Account schemes on the planet right away.

(fig. 12.2z)

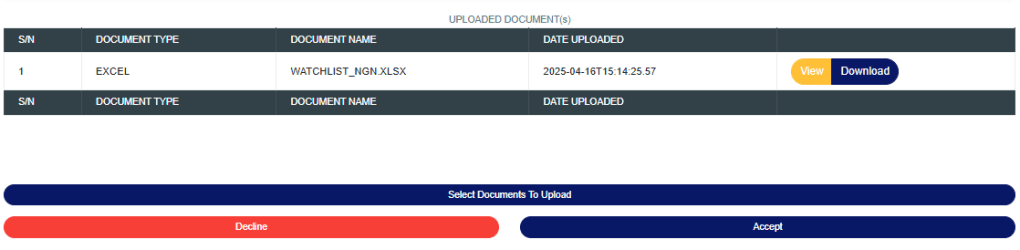

D) Bulk Upload of New Account Schemes.

- To add more than one new account scheme on the software; you must have an excel file filled with the details of the new account schemes according to the compliance planet’s file specification for uploading new account schemes. Here is how to make a bulk upload.

STEP 1: Click on ‘UPLOAD SCHEME’ as in fig. 12.2aa below.

(fig. 12.2aa)

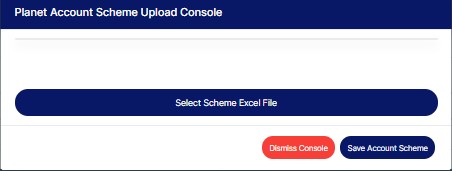

- This will display a ‘Planet Account Scheme Upload’ console as in fig. 12.2ab.

(fig. 12.2ab)

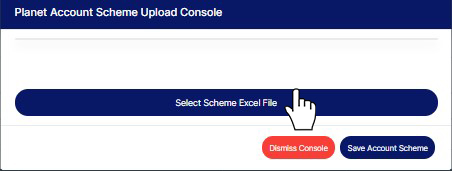

STEP 2: Click on ‘SELECT SCHEME EXCEL FILE’ as in fig. 12.2ac to choose the excel file filled with the details of the new account schemes to be uploaded on the software.

(fig. 12.2ac)

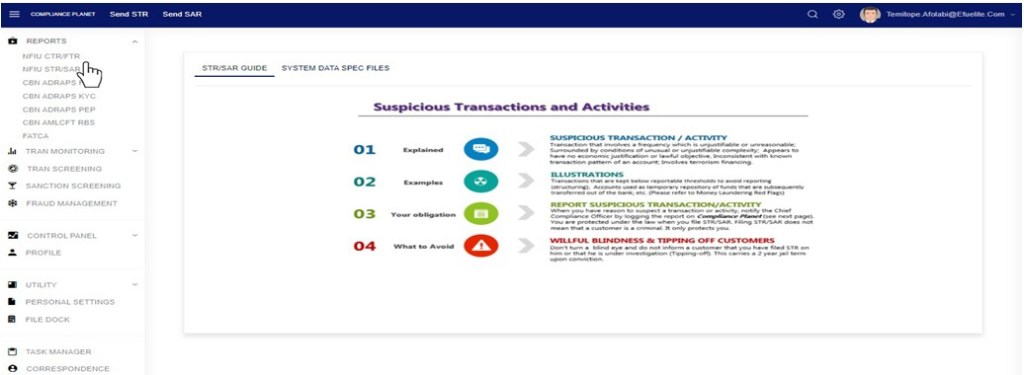

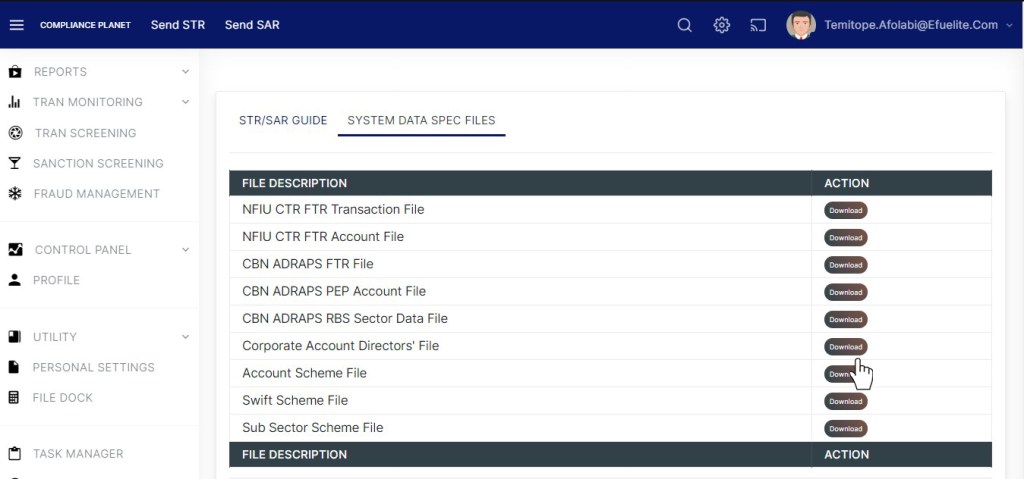

- If you do not have the file specification for uploading the new account schemes, you can download from the “SYSTEM DATA SPEC FILES” on the software home page as shown in fig. 12.2ad to download a file specification.

I

(fig. 12.2ad)

- This downloads an empty excel file with pre-filled headings (according to the required specification) under which the details for the new account schemes will be entered. Open the file, fill in the required details of the new account schemes and save the changes to the file. Renaming the file on your computer is optional. Now that you have a file to upload, click on ‘Select Scheme Excel File’ to choose that file for upload.

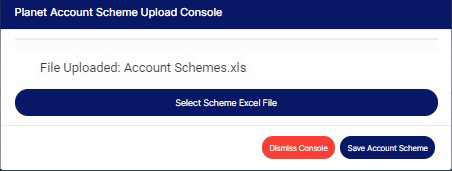

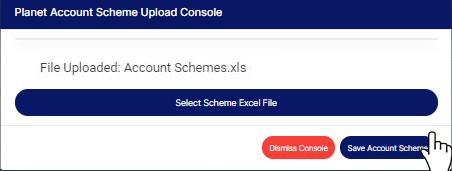

- After selecting a file from your computer, the name of the selected file will be added to the upload console. See fig. 12.2ae for an example.

(fig. 12.2ae)

- To close the upload console, click on ‘DISMISS CONSOLE’.

STEP 3: Click on the ‘SAVE ACCOUNT SCHEME’ button as in fig. 12.2af to save the new account schemes on the planet.

(fig. 12.2af)

- Clicking on this button will display a confirmation console. Click on ‘CONFIRM’ to proceed or ‘CANCEL’ to return to the upload console. See fig. 12.2ag for an example.

(fig. 12.2ag)

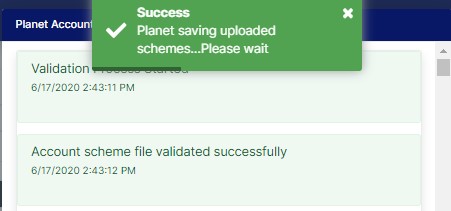

- A notification as in fig. 12.2ah below will be displayed at the top of the page as the software is saving the new account schemes.

(fig. 12.2ah)

For further enquiries :

Tel +234(0) 816 555 9818

Email solutions@efuelite.com

Web http://solutions.efuelite.com