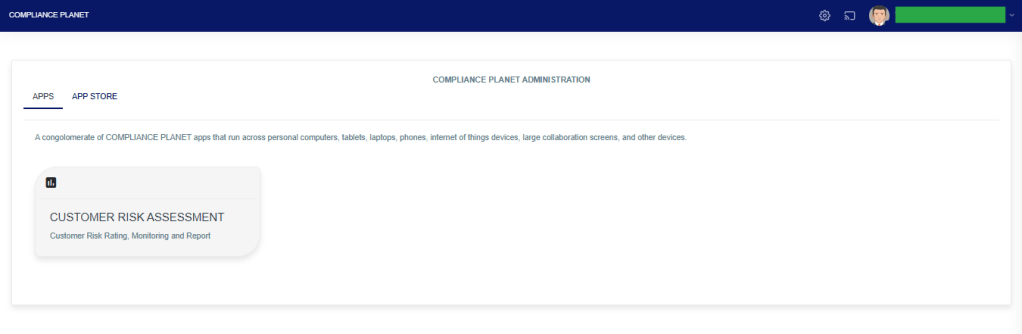

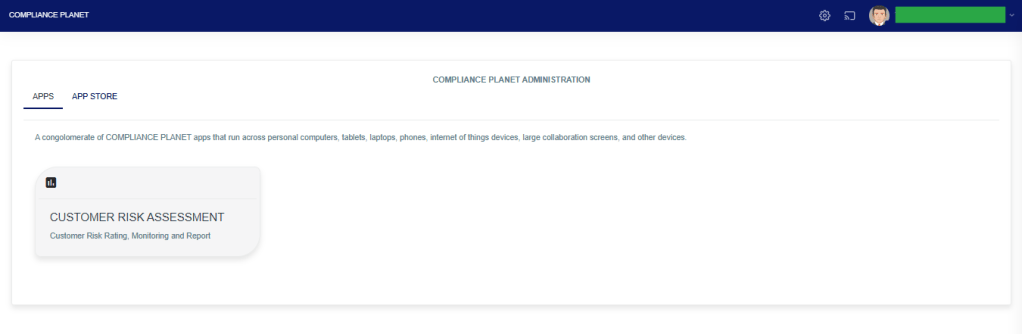

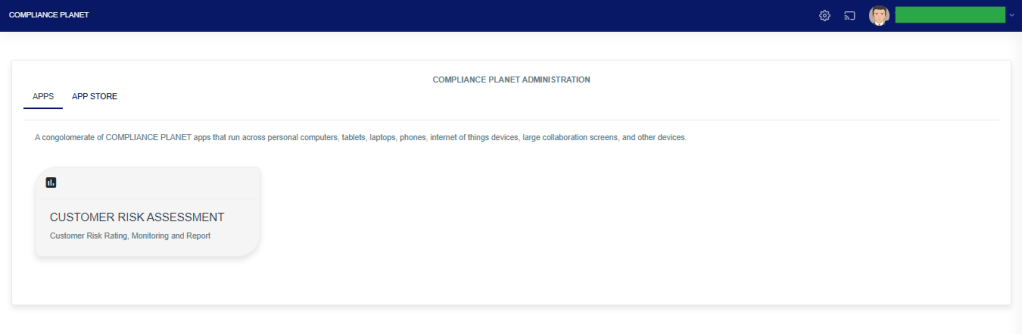

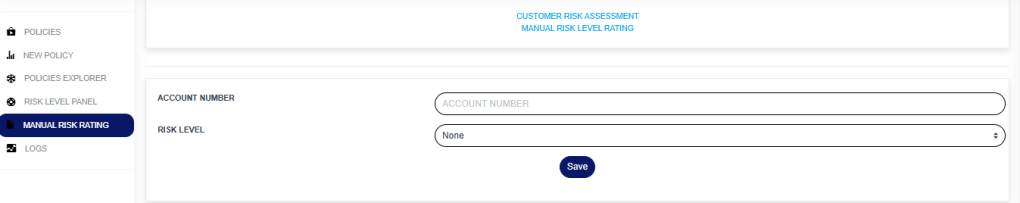

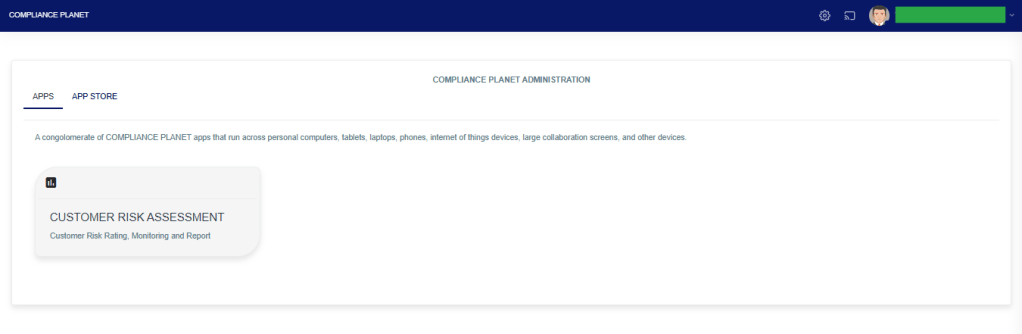

STEP 1: From app dashboard, click “CUSTOMER RISK ASSESSMENT” as in the image below.

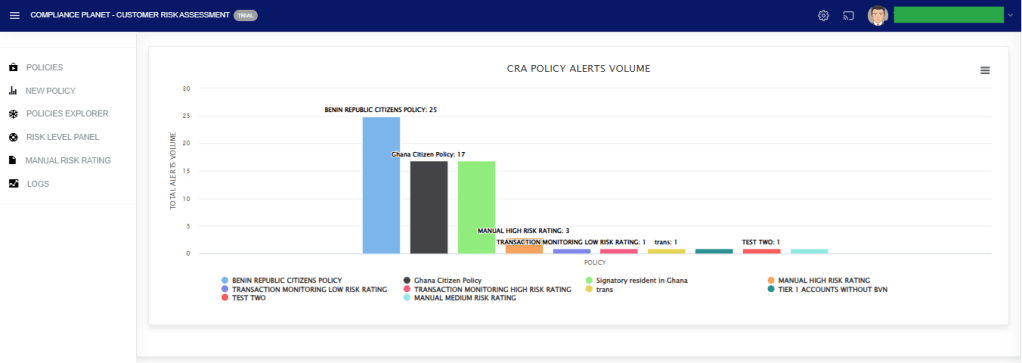

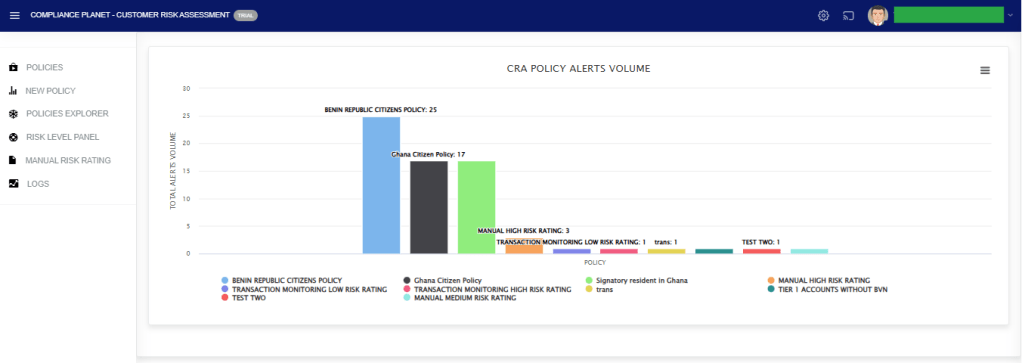

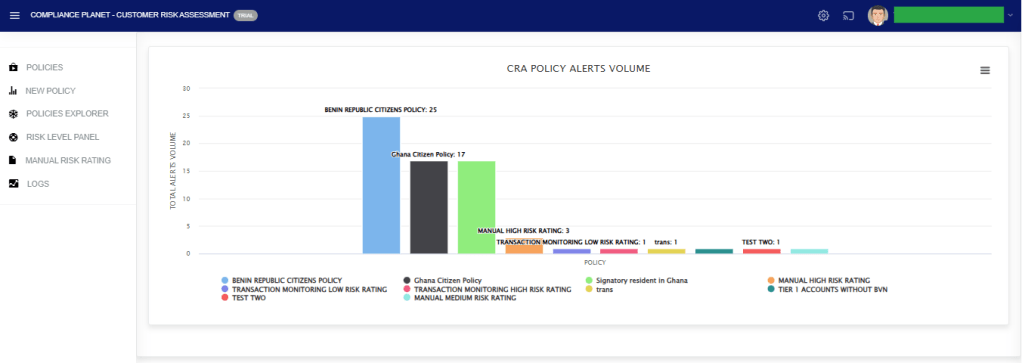

The above action will display a page as seen in the image below.

STEP 2: Click “POLICIES” to display the policy list as shown below.

Entries: Number of records to see on a page.

View Type: This option allows you to switch between active and inactive policies.

Search: This helps you search for a specific policy.

When any of the above filters is changed, click on the View button to see the result.

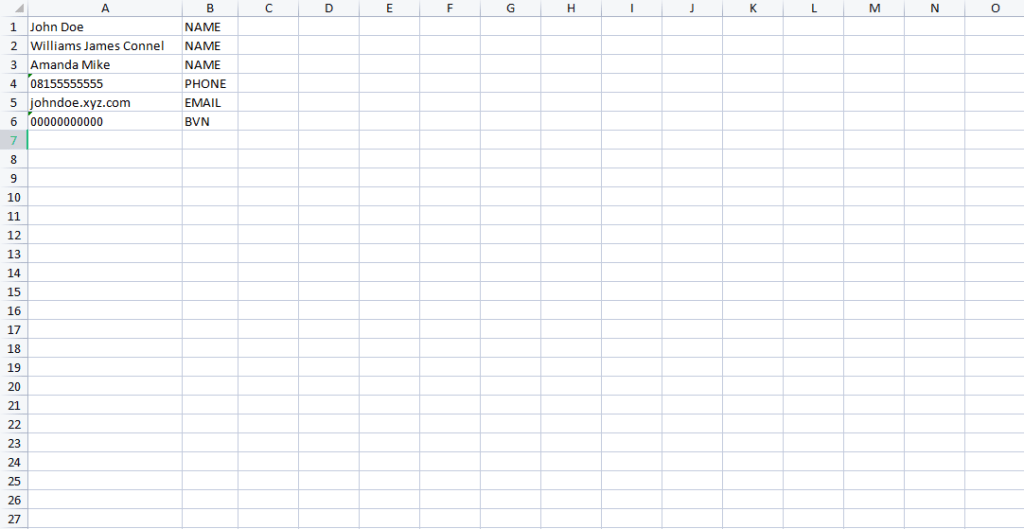

The data representation of the table columns is explained below;

Name: The name of the policy.

Risk level: The risk level of the policy.

Account: The number of accounts picked by the policy.

Status: The status of the policy(active or inactive).

There are three action buttons on each row with different functions as explained below;

Details: This displays all the parameters entered during policy creation. To edit these parameters, you must reset the policy.

Duplicate: This allows you to make a copy of the policy. The copy becomes inactive and is added to the inactive list.

Reset: This deletes all the records that the policy has picked.

For further enquiries:

Tel: +234(0) 816 555 9818

Email: solutions@efuelite.com

Web: http://solutions.efuelite.com