He is an accomplished Software Engineer/Developer and Business Analyst with over 16 years of experience in the field of Software Engineering and Development. My key areas of expertise include, but are not limited to the following;

- Web, Mobile Software Development, and Engineering

- Artificial Intelligence and Deep/Machine Learning

- Natural Language Processing (NLP)

- Recommendation Systems

- Association Rules

- Data Science, Business Analytics, and Modelling

- Business Policy Automation

- Fintech, Anti Money Laundering, and Financial Crime Automation (AML/CFT)

He is the MD/CEO of the Efuelite Group of Companies with subsidiaries; to mention are Efuelite Solutions Ltd, Efuelite Code Hub Limited, Efuelite Rides Limited, Efuelite Meals Limited, Spiritual Sound Records Limited, etc. He is focused on developing innovative business solutions which perfectly fit into business models and processes, greatly enhancing employee productivity, improving product and service quality, and increasing process efficiency. My experience spans across Financial, E-Commerce, Medical, Military, and Education sectors; from technical and functional solution service integrations with firms such as Nigeria Inter-Bank Settlement System (NIBBS), Nigerian Electronic Fund Transfer (NEFT), Central Bank Of Nigeria (CBN), Fintechs and

Commercial banks.

In 2011, he bagged a merit award from the National Youth Service Corps for developing solution(s) in northern Nigeria. Over the past few years, he has developed solutions that aided the Cashless Policy and Forex system from system rollout and technical support in challenging environments.

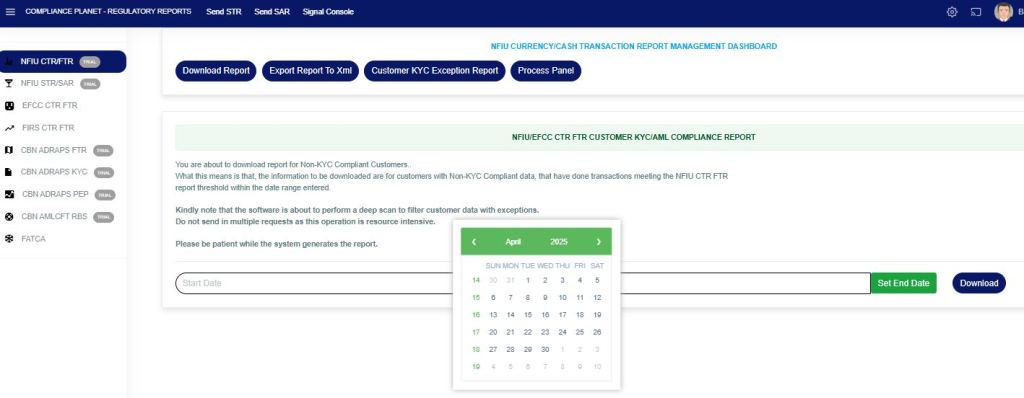

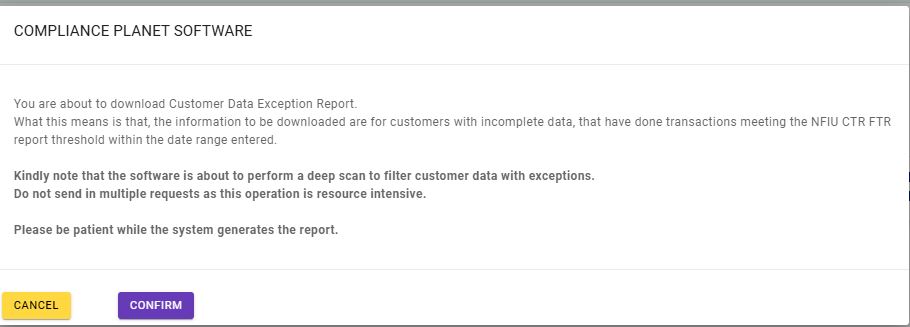

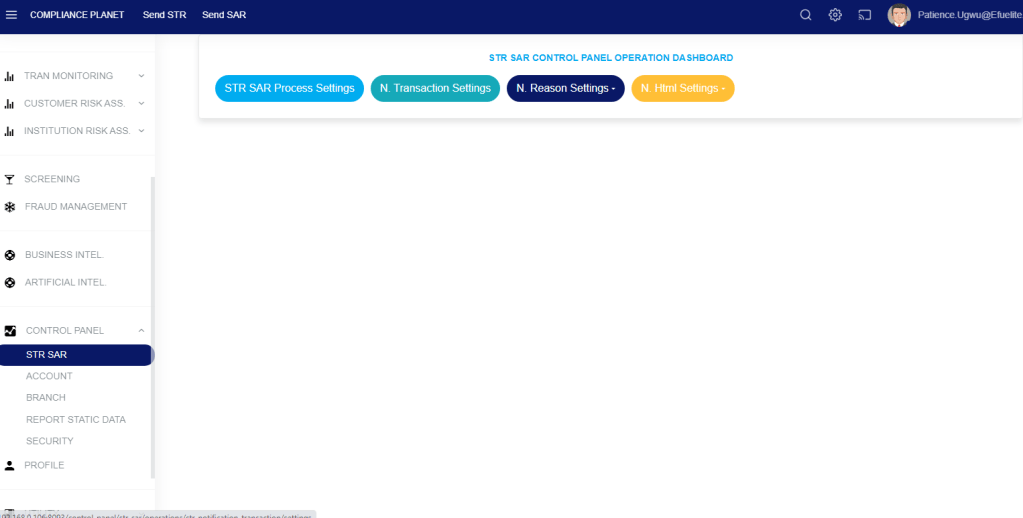

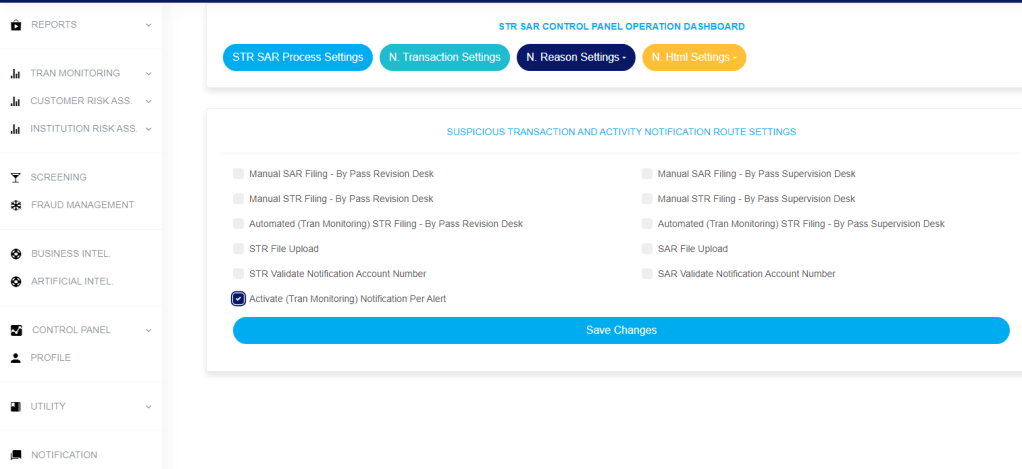

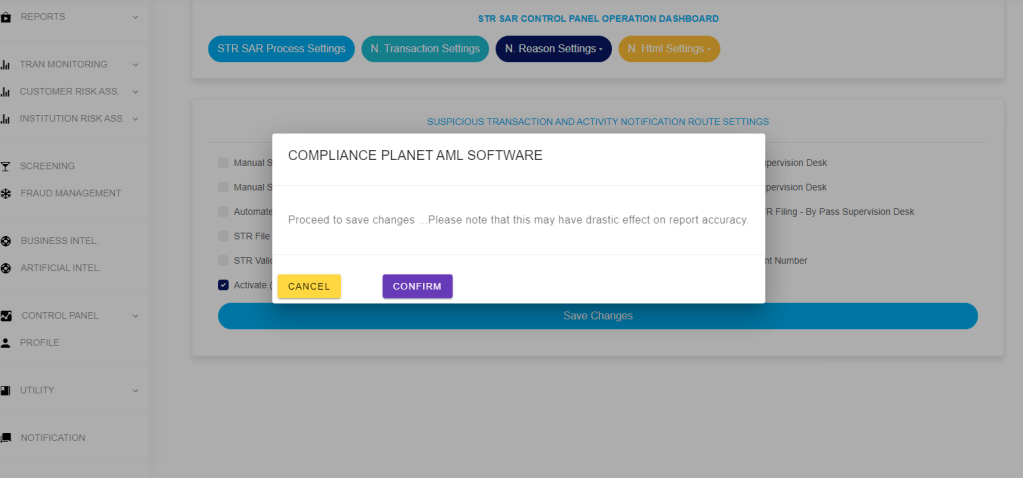

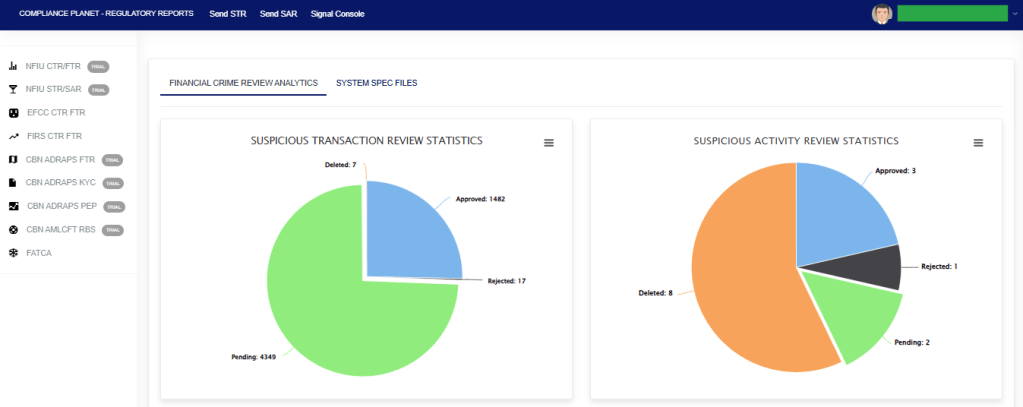

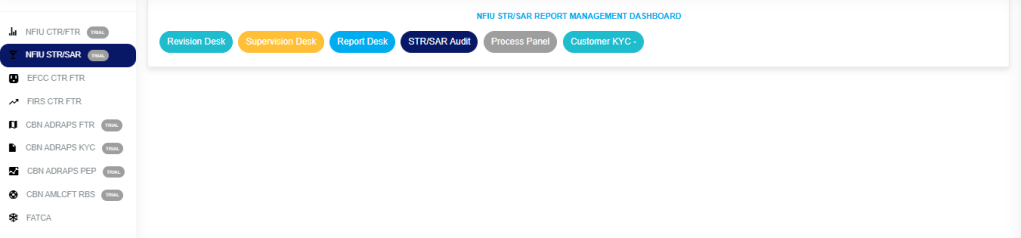

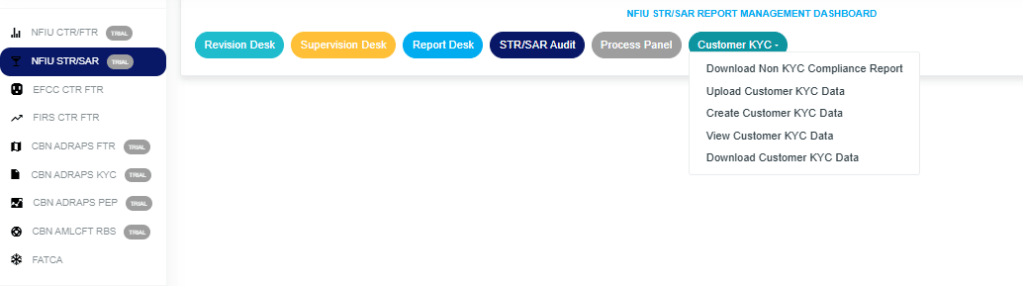

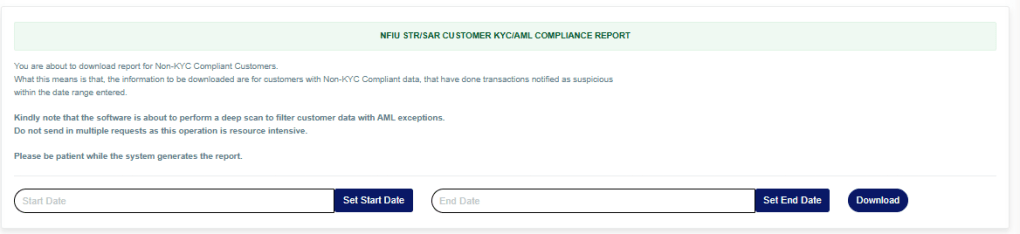

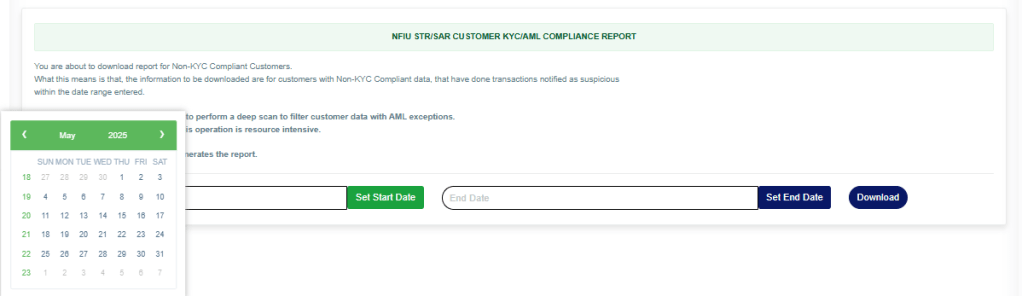

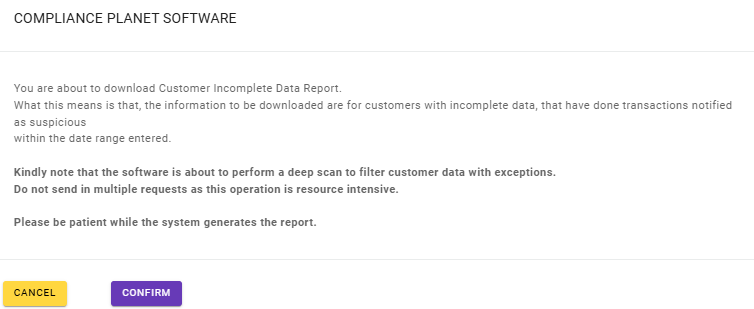

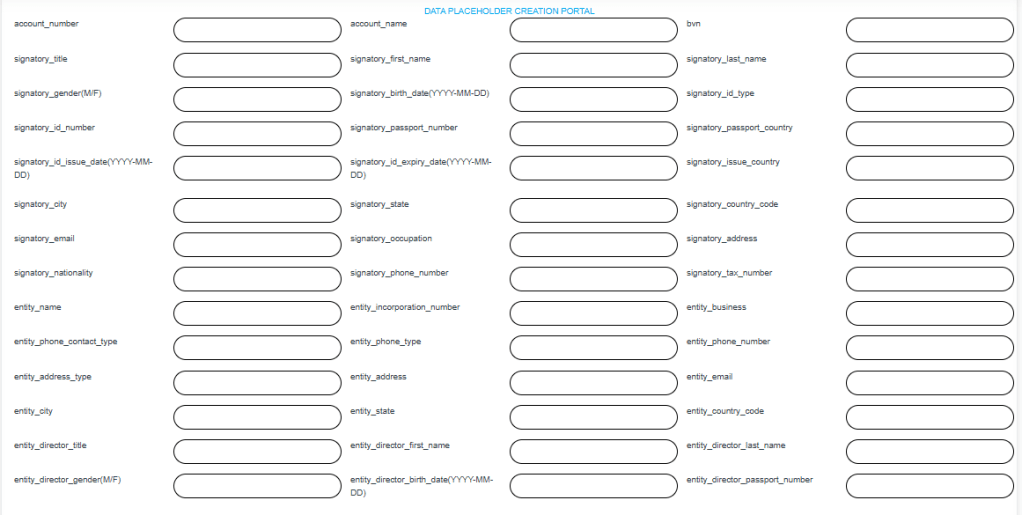

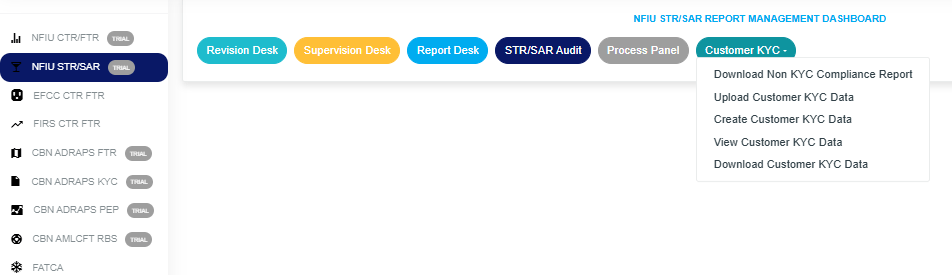

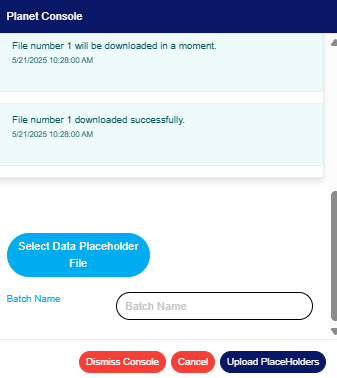

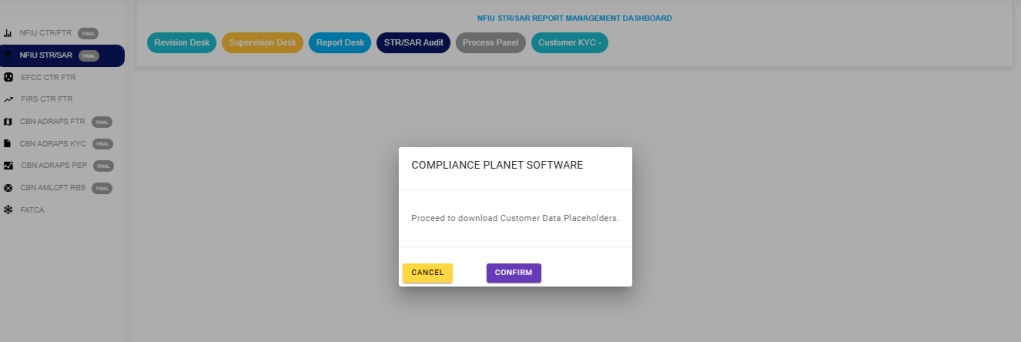

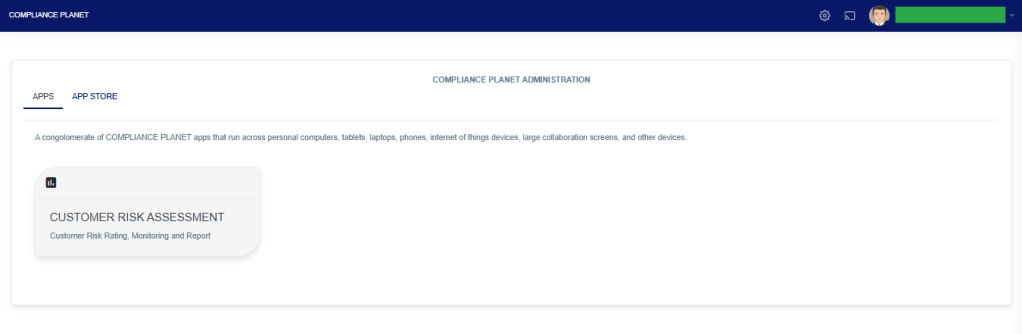

In 2017, he invented the Compliance Planet Anti Money Laundering (AML) Software an ISO 20700 certified product that enables financial institutions to discharge their data processing and reporting obligations under the Anti-Money Laundering and Combating Financing of Terrorism (AML/CFT) laws and regulations in Nigeria in the most efficient and effective manner.

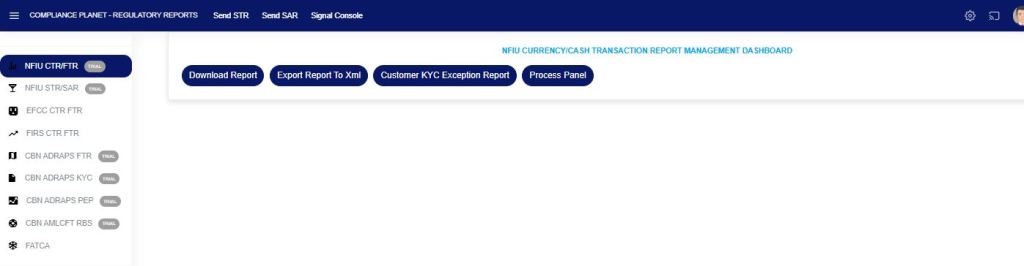

This software handles the following amongst others: –

- Reports under the Money Laundering (Prohibition) Act 2011 (as amended)

- Currency Transaction Report (CTR)

- Foreign Currency Transactions Reports (FTR)

- Suspicious Activity / Transactions Reporting (SAR/STR)

- Reports under the CBN AML/CFT Data Rendition and Processing Systems (ADRAPS)

- AML/CFT Risk-Based Supervision Reporting (RBS)

- Politically Exposed Persons Reporting (ADRAPS PEP)

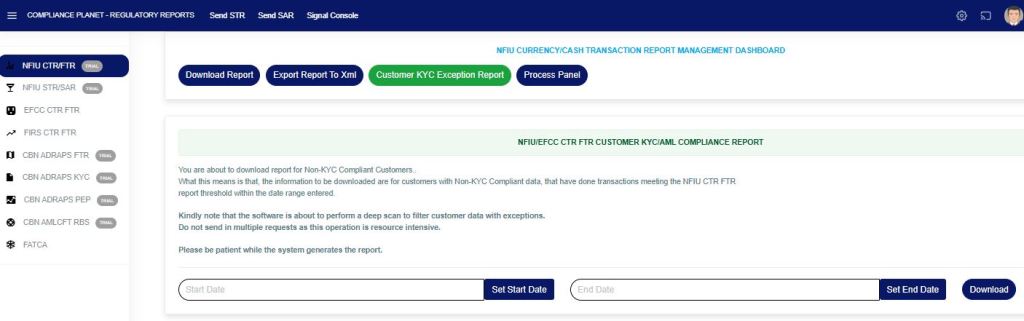

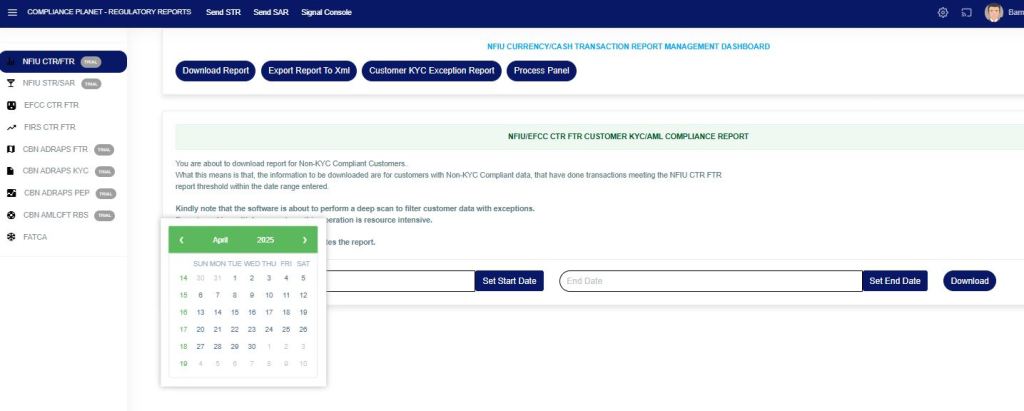

- Three Tiered KYC reports

- Foreign Currency Transaction Report (ADRAPS FTR)

- Report to the US Internal Revenue Service (IRS) under the Foreign Account Tax Compliance Act (FATCA)

- Workflow for electronic submission, review, and approval of Suspicious Transactions to the Compliance Department / Chief Compliance Officer.

- Transaction Monitoring / Screening.

- Report monitoring / Workflow / Analysis.

- Data Governance, Data Mining, Machine Learning, and many more.

- Validation of Foreign Nationals

- Sanction Monitoring/Screening.

- Enhanced Due Diligence

- Fraud Monitoring.

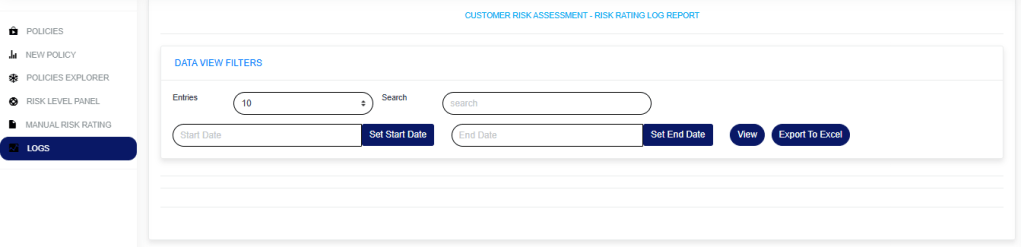

- Customer Risk Assessment and Monitoring.

- Adverse Media Screening.

This software has its Patent with the Federal Republic of Nigeria RP: NG/PT/2018/2767.

Over the past few years, he has developed solutions that aided the Cashless Policy and Forex system from system rollout and technical support in challenging environments.

Prince has contributed vastly to the Microsoft open-source community of developers by building several NuGet programs widely used by programmers worldwide.

Some of his open-source projects and contributions are:

NuGet Gallery | Packages matching prince efue

NuGet Gallery | EfueliteSolutionsDateHelper 1.0.12

NuGet Gallery | EfueliteSolutionsRandomHelper.Core 1.0.0

NuGet Gallery | EfueliteSolutions.DbLogger 1.0.0

NuGet Gallery | EfueliteSolutionsMSSQLReaderHelper.Core 1.0.2

NuGet Gallery | EfueliteSolutions.APIConnect 1.1.4

NuGet Gallery | EfueliteSolutionsORACLEReaderHelper 1.0.0

He has a master’s degree in Business Management and Leadership from the London Graduate School; as well as a Doctorate degree awarded in Business Administration from the CommonWealth University London.

He has a postgraduate degree in Artificial Intelligence and Machine Learning (Business Applications) From the University of Texas at Austin.

He is a certified Google Data Analytics Professional.

He has a BSc in Biochemistry from Delta State University. A native of Delta State. He attended Code Academy College USA, a Fellow of the International Institution of Management Consultants, and a Certified Management Consultant.